BY

|

A Guide to E-Invoicing and Your ATO Requirements

Over the past decade, the business world has seen a digital revolution.

Technologies like email, instant messaging, and video conferencing continue transforming communication and collaboration within each business process. Cloud-based services allow teams to operate anywhere in the world with just a few clicks, and social media has created new marketing and customer service channels.

In many cases, businesses are now able to operate far more efficiently and effectively than ever before. For example, in the past, companies had to rely on paper invoices to keep track of payments and receivables. But, with the advent of e-invoicing, businesses can now send and receive digital invoices.

This has revolutionised business-to-business relationships, making it more convenient to send professional invoices, get paid faster, and manage receivables.

The Australian Tax Office (ATO) and the federal government recently started mandating e-invoicing for all Commonwealth government agencies, and continue to advocate for the numerous benefits of adopting a more digital approach to payments.

So, here’s what you need to know.

What is E-Invoicing?

E-invoicing is the electronic exchange of invoices between a buyer and supplier. You can do this through various means, but the most common is an online platform connecting the two accounting systems. By automating the exchange of invoices, businesses can save time and money by reducing the need for manual entry & processing.

Other benefits include:

- Faster payments

- Improved accuracy

- Improved business relations

- Increased security

- Environmental benefits

The Australian e-invoicing digital exchange standards are built on the Pan-European Public Procurement On-Line (Peppol) Framework.

What is Peppol?

The Pan-European Public Procurement On-Line (Peppol) Framework is a set of standards and specifications designed to facilitate electronic document exchange (such as electronic invoicing) between public authorities and businesses across Europe.

Based on the 4-corner model, the Peppol network provides a platform for exchanging documents between different service providers. The Australian government is already using the Peppol network for SuperStream to automate superannuation contributions, and it is expected to become increasingly popular in the coming years.

The ATO is the primary Peppol authority for Australia, giving them the responsibility to develop and administer the framework to implement e-invoicing in Australia. For example, in August 2022, they launched “e-invoicing week” to help guide employers looking to switch over to an e-invoicing system.

They also control the specifications for online invoicing and manage the use of online invoices via the e-invoicing network.

How Do You Register for E-Invoicing?

According to the ATO, if you’re ready to switch to e-invoicing, you’ll need to start by registering on the Peppol e-invoicing network. You can do this by either using:

- existing accounting software equipped for e-invoicing,

- an e-invoicing service provider, or

- an online solution listed on the product register that provides low-cost or even free services

If you’re unsure which option would suit your business, you should get in touch with your business accountant or advisor to help you get started.

The ATO also has various resources that aim to help guide entities in making the transition to e-invoicing:

- Getting started with e-invoicing for small business

- Getting started with e-invoicing for medium and large businesses

Making the Transition to an e-invoicing System

Here’s a quick overview of the critical steps you need to take to ensure your transition goes off without a hitch.

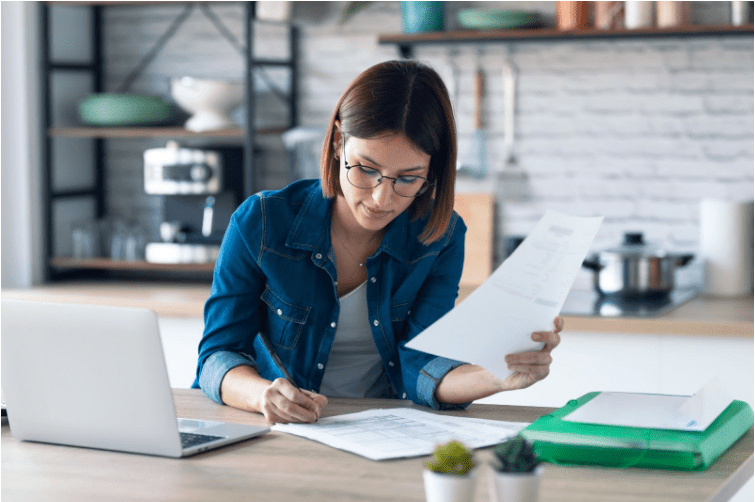

Review Your Business Processes

The first step is to look closely at your current invoice processing system. What are the pain points? Where do delays typically occur? Having a clear understanding of your current state will help you map out a more efficient process using an e-invoicing system. Remember to consider unpaid invoices, payment reminders, the billing process, and how your customers pay you.

Communicate with Trading Partners

Once you’ve identified the bottlenecks in your current process, it’s time to start talking to your trading partners and suppliers about switching to e-invoicing. Many businesses are hesitant to change established processes and new invoice templates, so it’s essential to clearly communicate the benefits of e-invoicing and how it will improve efficiencies for both parties. Be prepared to answer any questions or concerns about how they send estimates, receive e-invoices, create and monitor the status of transactions on the dashboard and more.

Update Customer Records

Now that you’re ready to start using an e-invoicing system, it’s vital to ensure all your customer records are up-to-date and accurate. This includes all the information you need to meet ATO tax invoice obligations. If you still need to get the required information on hand, now is the time to get it so that you can avoid any delays down the road.

Onboard Trading Partners

The last step is to enrol your business partners and suppliers in the e-invoicing system. This typically involves helping them with links to training materials or FAQs. Once they’re up and running, you’ll be able to take advantage of all the benefits of using an e-invoicing system, including how you send invoices, receive invoices, organise purchase orders, manage late payments and more.

Key Takeaways

The benefits of e-invoicing are undeniable. An e-invoicing system can save your business time and money while improving your relationships with trading partners. But making the switch from traditional invoicing to e-invoicing can be daunting.

That’s where Box Advisory Services comes in.

We’re a team of business accountants, and advisors who help entrepreneurs and small businesses grow and succeed. We provide expert advice and support in all areas of financial management, from bookkeeping to tax planning to long-term strategy.

We also specialise in helping businesses with the e-invoicing implementation process from start to finish.

Our mission is to help our clients achieve their goals through smart financial planning and sound business advice. We believe that, with the proper guidance, any business can thrive. With over 20 years of combined experience in the industry, we’re confident in our ability to help your business reach its full potential.

Contact us today to learn more!