BY

|

Discretionary Trusts: Everything You Need to Know

Discretionary trusts are widely used for asset protection purposes and tax management.

But, by transferring your assets into a discretionary trust, you will no longer own the assets.

So, how exactly do discretionary trusts work? What are the advantages and disadvantages? How do you set up a discretionary trust in Australia?

It’s worth being equipped with all the information before going ahead with establishing a discretionary trust.

Here’s what you need to know.

What Is a Trust?

Before delving into discretionary trusts and how they work, you’ll need to have a basic understanding of trusts in general.

A trust is a legally recognised relationship that exists between party A and party B. Party A holds property for the benefit of party B.

Party A, known as the trustee, is the legal owner of the trust assets (for example, investment property); and party B is the beneficiary of those trust assets.

Like following a recipe or assembling something you bought at Bunnings, you need to make sure you have everything you need before you start.

The “ingredients” or “tools” you’ll need when setting up a trust is discussed below in the section where we talk about setting up a trust.

When you’re cooking or building something, you must follow the recipe or instructions to a tee. The same applies to trusts.

While certain rules and regulations are inherent to the type of trust you open, other rules depend on what is detailed in the trust agreement.

What Is a Discretionary Trust?

Discretionary trusts are trusts where the beneficiaries don’t have a predetermined interest in the trust assets.

In other words, the trustee is given complete discretion as to how the trust income is distributed to the beneficiaries.

Discretionary trusts are the most common type of trusts in Australia because it offers the most flexibility in distributing trust income.

An example of a discretionary trust is a family discretionary trust.

A family trust is typically set up to manage a family business or hold a family’s personal or business assets.

There are several reasons why individuals end up setting up discretionary trusts. The most common reasons include:

- for asset protection – assets held in a discretionary trust are separate from the assets of the beneficiaries so that the trust assets will be protected from creditors;

Disclaimer: there are plenty of reasons assets are not necessarily “safe” just because they are sitting in a trust. Please consult a solicitor for advice regarding asset protection around trusts because it is a grey area and depends on the individual’s personal situation.

- for property investment – discretionary trusts can be used as a vehicle to purchase investment property;

- for business investment – a discretionary trust can be used to purchase interests in a business or company; and

- to manage family income.

How To Set Up a Discretionary Trust

Parties To a Discretionary Trust

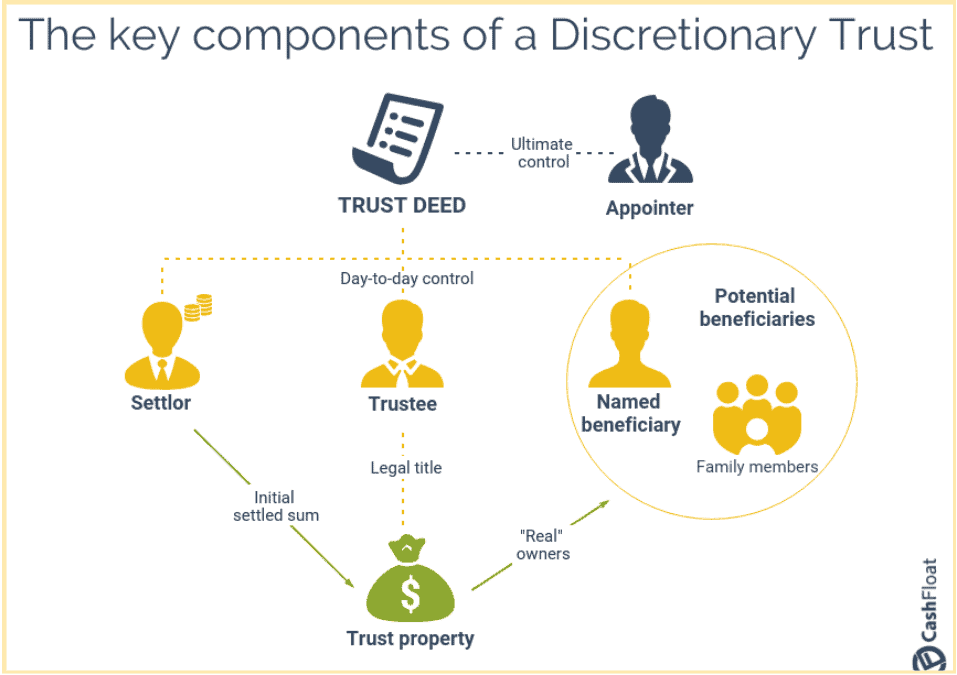

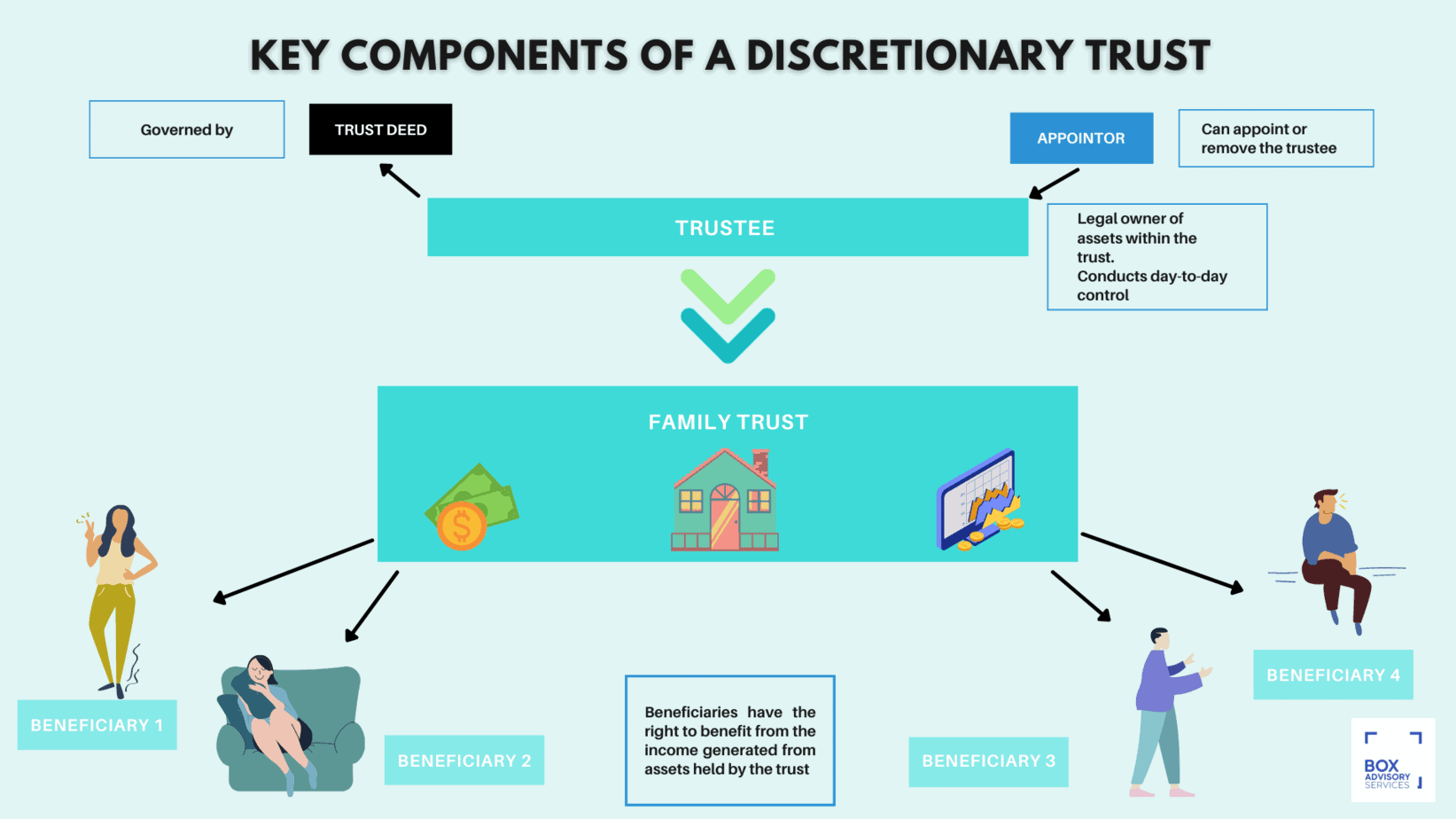

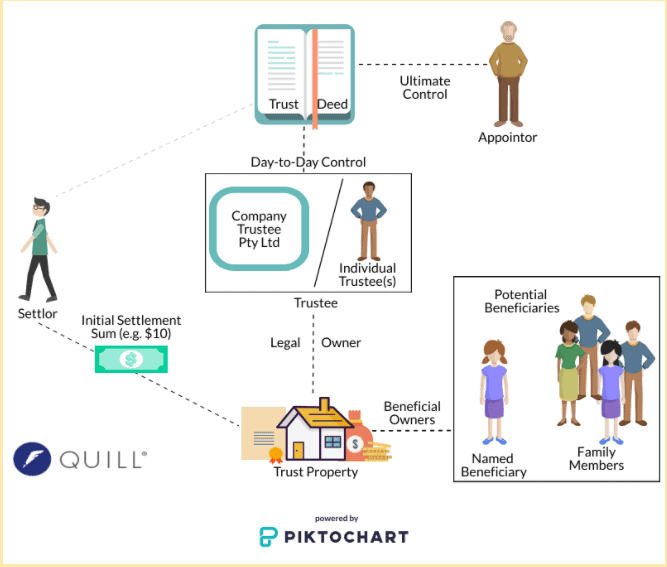

When setting up a discretionary trust, various parties must be established, including:

-

- the trustee is the party responsible for ensuring that the trust is managed in accordance with the trust deed;

- Directors of a corporate trustee (only if the trustee is a company)

- the beneficiaries benefit from the income of the trust but have no control over the trust; and

- the settlor is responsible for initiating the set-up of the trust, appointing the trustee and naming the beneficiaries.

- Appointor – The person or entity that has the right and power to remove and nominate trustees. Usually, this happens when a trustee passes away or cannot continue to manage the trust for some reason. The Appointor could be a company or a person.

Setting Up the Discretionary Trust

Before setting up a discretionary trust, we suggest that you consult with a financial advisor or accountant because each individual’s circumstances are different, and the objectives of the trust should align with those circumstances.

However, here are the seven steps to establishing a family trust

- Step 1 involves selecting the trustee or trustees.

- Step 2 is where the trust deed is drafted. The trust deed is the legal agreement that describes how the discretionary trust will operate and establishes the trustees’ responsibilities.

- Step 3 requires a settlor to be appointed. Once appointed, the settlor must sign the trust deed and hand over the initial settlement sum to the trustees.

- Step 4 involves a meeting between the trustees and the beneficiaries where the trust deed is formally accepted.

- In step 5, the trustee will need to lodge the trust deed with the relevant revenue authority (such as Revenue New South Wales) and pay stamp duty if applicable.

- Step 6 requires the trustee to apply for an Australian Business Number (ABN) and a Tax File Number (TFN) for the trust.

- Step 7 is where a bank account is opened for the trust.

What Are the Advantages of Discretionary Trusts?

We previously mentioned that discretionary trusts are commonly used to benefit from asset protection and investments. But here are a few more advantages:

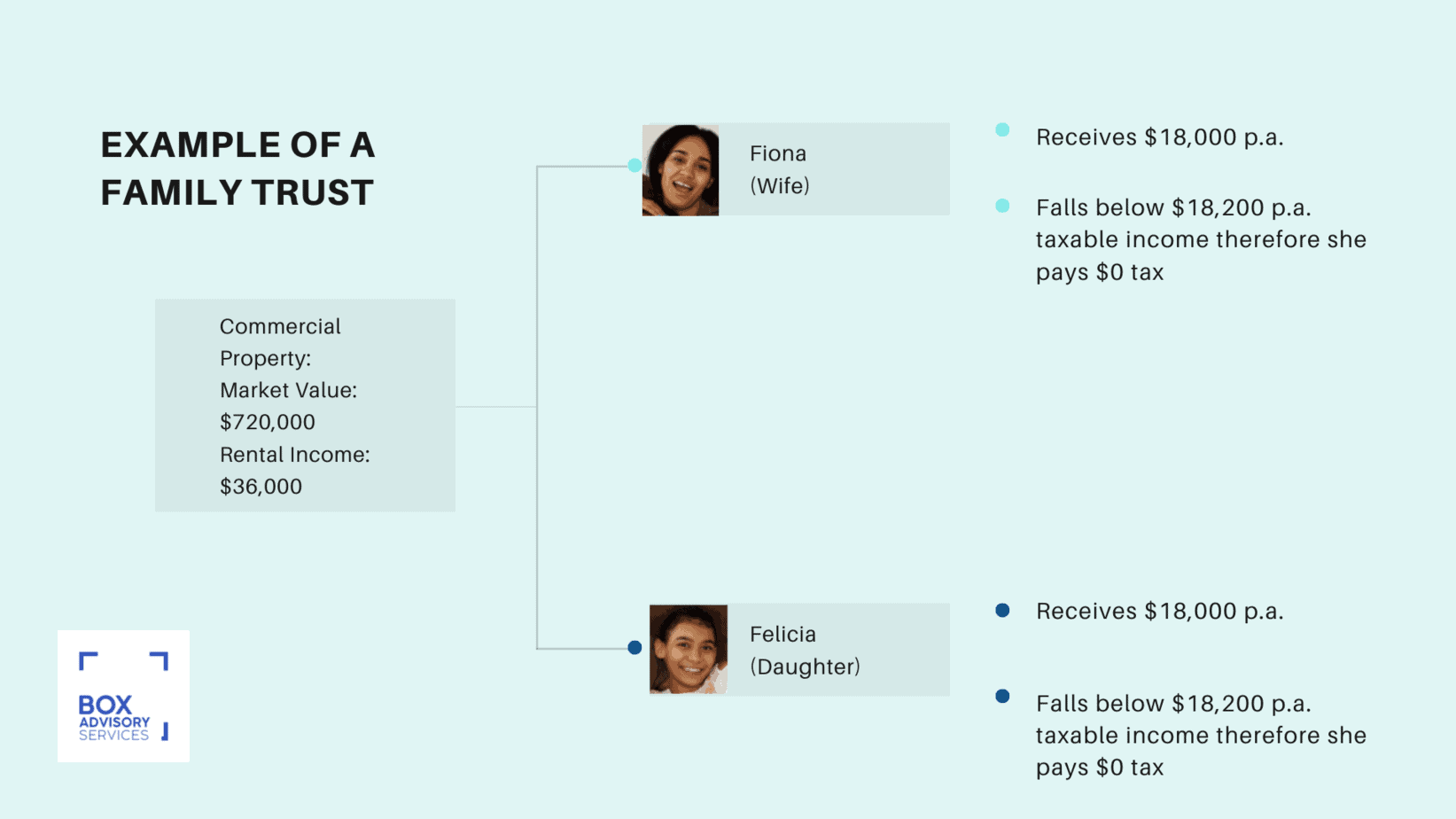

- Tax benefits: discretionary trusts can be an effective way to manage your tax obligations.

Any income received for investments held in the trust can be distributed at the trustee’s discretion, which means if one beneficiary is paying more income tax than another, the income can be distributed in a manner that equals out the amount of tax each beneficiary is liable to pay.

For example, if one beneficiary earns far more than another beneficiary is tax at the top marginal rate, it would make sense to distribute a greater share of the trust income to the beneficiary who is taxed at a lower marginal rate.

This is especially beneficial in discretionary trusts held by spouses.

- Capital Gains Tax benefits: any investment held in the trust for more than 12 months will be eligible for a 50% CGT discount at the occurrence of a CGT event.

- Estate planning: one way of minimising disputes regarding the distribution of your estate is to set up a testamentary discretionary trust under your Will. A testamentary discretionary trust will only come into effect on death, and income can be distributed to your beneficiaries via the trust rather than in accordance with a will.

What Are the Potential Disadvantages of Establishing Discretionary Trusts?

But, there are some potential disadvantages you should consider before setting up a discretionary trust:

- Losses get trapped: if any of the trust assets end up running at a loss, the loss will remain trapped inside the trust and gets carried forward to later years. The losses are then offset against future profits.

- Land tax fee threshold might not be applicable: in NSW, for example, property owned by discretionary trusts don’t qualify as a land tax-free threshold. This can to a significant increase in land tax to the trust.

- Discretionary trusts are still liable: while a discretionary trust can be used as an asset protection strategy against your personal creditors, a discretionary trust can have its own creditors, and those creditors have a right to property or business interests held in the trust.

- Beneficiaries who placed funds into the trust don’t have the power to liquidate their holdings (especially in the case of properties) unless the trustees allow it. This may cause disputes amongst family members.

Key Takeaways

Discretionary trusts are a common trust structure for many Australian families because it offers asset protection, flexibility and certain tax benefits.

However, not every individual’s circumstances are the same, so you’ll need to establish whether a discretionary trust is a proper structure for you and your objectives.

Consulting with a financial advisor or an accountant can help guide you in the right direction when it comes to identifying the correct trust structure for you.

To find out how Box Advisory Services can help you with your trust-related queries, book a free consultation with us today!

Disclaimer:

Please note that every effort has been made to ensure that the information provided in this guide is accurate. You should note, however, that the information is intended as a guide only, providing an overview of general information available to property buyers and investors. This guide is not intended to be an exhaustive source of information and should not be seen to constitute legal, tax or investment advice. You should, where necessary, seek your own advice for any legal, tax or investment issues raised in your affairs.