BY

|

What is a Chartered Accountant & Do You Need One?

If you’re a business owner, you’ve probably heard the term “Chartered Accountant” but aren’t sure what sets them apart from your regular accountant. Chartered accounting is a globally respected profession with rigorous educational, experiential, and ethical standards. If you’re a student or career-changer, you’re weighing whether the CA pathway is worth the commitment.

Here’s the reality: a Chartered Accountant is more than someone who files your tax return or balances your books. They’re strategic advisors trained to turn complex financial rules into practical business decisions on pricing, structures, funding and risk.

This guide explains what CAs do, how they specialise, when businesses need them, how to become one, and whether the CA pathway is right for you. Becoming a Chartered Accountant opens up diverse career opportunities and provides a competitive edge in the accounting field.

What Is a Chartered Accountant?

A Chartered Accountant (CA) is a qualified financial professional accredited by Chartered Accountants Australia and New Zealand (CA ANZ), an institute that sets the standards for the profession, who has completed rigorous training in four core disciplines:

- Accounting and financial reporting

- Financial management

- Taxation

- Auditing.

The chartered accountant designation is awarded to candidates who meet strict educational, practical experience, and ethical standards, making them eligible for internationally recognised qualifications that enhance global career mobility.

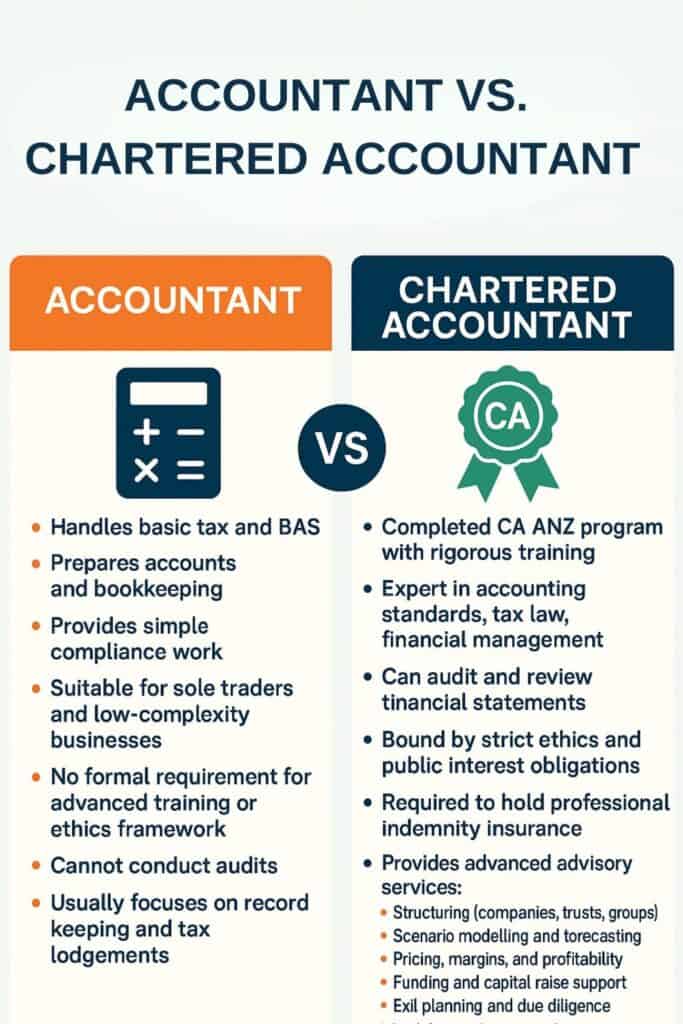

Accountants vs. Bookkeepers vs. Chartered Accountants

Unlike general accountants or bookkeepers, CAs sit at a higher level of training, authority and scope. They’re authorised to prepare, review and audit financial statements, and are bound by CA ANZ’s strict code of ethics and public-interest obligations.

To qualify for chartered accountant membership, candidates must meet specific entry requirements, including:

- holding an undergraduate degree in a relevant field

- completing a graduate diploma,

- and enrolling in the chartered accountants program.

This program requires candidates to complete both coursework and a period of mentored practical experience. Candidates first apply for provisional membership and, after completing all requirements of the chartered accountant program, become eligible to apply for full chartered accountant membership, gaining internationally recognised qualifications.

Think of Chartered Accountants as “translation layers” between complex rules and real-world business decisions. They turn dense accounting standards (AASB), tax legislation (Income Tax Assessment Act, GST Act) and sector-specific regulations into practical guidance on pricing, funding structures, risk management and compliance.

An Example

Sarah, a café owner in Melbourne, thought her accountant was just there to lodge her BAS and annual tax return. When she switched to a CA, he reframed her P&L to show that her coffee beans and labour costs were eating 78% of revenue—far above the industry benchmark of 65%.

He modelled three pricing scenarios and helped her negotiate with her supplier, ultimately improving her gross margin by 9% and freeing up cash flow to hire a part-time barista. That shift—from compliance tick-box to strategic partner—is what sets CAs apart.

What Do Chartered Accountants Actually Do?

At a high level, Chartered Accountants ensure that financial information is prepared, presented and disclosed correctly so that management, lenders, investors and regulators can rely on it to make informed decisions.

Their core duties include:

- Preparing and reviewing financial statements

- Interpreting financial data for management

- Ensuring compliance with accounting standards (AASB) and tax law,

- and providing independent assurance through auditing.

But the work goes far beyond ticking boxes…

Where Chartered Accountants Work in Australia

Chartered Accountants (CAs) work across both the private sector and public practice, and are recognised as leaders in the accounting field. As accounting professionals and members of professional institutes, CAs hold a wide range of roles and responsibilities.

CAs work in three main environments:

In-house roles

Financial accountants, finance managers, financial controllers and CFOs who work inside businesses. They prepare monthly management accounts, analyse performance, build budgets and support strategic decisions.

In practice

CAs working in accounting firms—from small practices to Big 4—provide services to multiple clients across tax compliance, tax advisory, audit, financial reporting, business valuations, mergers and acquisitions, and restructuring advice.

Members who wish to offer accounting services to the public must meet public practice requirements, such as obtaining a Certificate of Public Practice (CPP).

Specialist roles

Some CAs focus on niche areas like forensic accounting, insolvency and restructuring, technical accounting advisory, or sector-specific regulatory work (banking, superannuation, not-for-profits). Auditors are a key example of specialist roles within the profession.

From Compliance to Strategy

The best way to understand what CAs do is to see them as professionals who turn complexity into clarity. The responsibilities of a CA vary depending on their role and the size of the organisation, covering a broad range of tasks from compliance to strategic advisory.

Where a general accountant might process your BAS and lodge your tax return, a CA can also interpret new accounting standards, model the tax impact of different business structures, advise on funding options, and help you decide whether to lease or buy that new piece of equipment.

A Real–World Example

James runs a construction business that turns over $4 million annually. His bookkeeper kept the Xero file tidy, but James never really understood his numbers. When he engaged a CA, they sat down together for two hours and walked through the P&L and balance sheet line by line. The CA was responsible for advising on business practices and providing advisory services that directly improved profitability.

The CA showed James that his gross profit margin was 28%—well below the industry benchmark of 35%. After digging into job costing, they discovered two issues: labour overruns on fixed-price jobs and materials wastage. The CA helped James implement a simple job tracking system in Xero, adjust his quoting process to include contingency buffers, and negotiate better trade terms with his main supplier.

Six months later, James’s gross margin had improved to 33%, freeing up an extra $200,000 in annual cash flow—money he reinvested into hiring a site supervisor and tendering for larger commercial projects. That shift from “here are your numbers” to “here’s what your numbers mean and what you should do about it” is the CA difference.

Should You Hire a Chartered Accountant?

For most business owners, the question isn’t “What letters come after their name?” but “Will this person add value beyond what I’m already getting?”

Here’s when the distinction genuinely matters:

Simple compliance (sole trader, straightforward tax and BAS): A general accountant or registered tax agent is sufficient and cost-effective. You don’t need a CA to lodge qa uarterly BAS if your structure is simple.

Multi-entity structures, trusts, cross-border transactions: A CA or CPA brings the technical depth to navigate complex structuring, related-party transactions, trust-deed compliance, consolidation accounting, and cross-border tax without costly errors.

Capital raises, funding applications, and major transactions: Lenders and investors often expect—or require—audited or reviewed financial statements signed by a CA (or CPA). Technical advisory on deal structures, valuations and due diligence also benefits from CA-level training.

Strategic growth and decision support: CAs trained in management accounting and financial management can move beyond compliance into scenario modelling, pricing strategy, cash-flow optimisation and profitability analysis—becoming a strategic partner, not just a compliance cost.

Proficiency in accounting software is increasingly important for CAs, as it enables efficient data management and reporting. Strong time management skills are also essential for CAs to handle complex projects and tight deadlines effectively.

Example Comparison

Two business owners in the same industry illustrate the difference.

Owner A runs a sole-trader consultancy, turning over $280K. Her accountant (no designation) charges $1,800 annually for tax return prep, BAS lodgements and basic tax planning. She’s happy—her needs are straightforward, and the service matches the complexity.

Owner B runs a property development group: a company as trustee for a discretionary trust, a unit trust holding three development sites, and 12 employees. He initially used the same type of accountant for $4,500 per year.

When Owner B approached a bank for a $2.5M development loan, the bank requested audited financials and flagged issues: trust distributions weren’t documented properly, related-party loans had no formal agreements (triggering Division 7A risk), and the company’s financials didn’t clearly separate development projects (making profitability hard to assess).

He engaged a CA who restructured the group, implemented proper documentation, separated project accounting, and prepared investor-grade financials. The bank approved the loan, but more importantly, Owner B could now see—for the first time—which projects were actually profitable and where his cash was going.

The CA’s fee was $18,000 annually, but the value was a funded project, avoided ATO penalties (estimated $40K+), and provided clear financial visibility to make better decisions.

The lesson: Match the advisor to the complexity. Owner A doesn’t need a CA; Owner B was flying blind without one.

How Do You Know if a CA is What You Need?

For business owners, the question isn’t “What is a CA?” but “What will a CA do for me that another accountant won’t?” The answer depends on where your business is in its lifecycle.

When You’re Starting Up

CAs help you get structures right from day one. They advise on the optimal legal structure—sole trader, company, trust, or hybrid—based on your industry, risk profile, growth plan, and tax position.

They set up compliant record-keeping systems from the start, ensuring you’re registered correctly for tax (ABN, GST, PAYG) and understand what records the ATO expects if you’re ever audited.

Many founders don’t have a finance background. A CA can walk you through your P&L, balance sheet, and cash flow statement so you understand what drives profit and where cash is actually going—not just what the bottom line says.

CAs also build simple cash-flow forecasts and scenario models: “What if sales are 20% lower in Q2? What if I hire two months earlier than planned? When can I realistically afford that new piece of equipment?”

Example

Sophie launched a boutique PR consultancy as a sole trader. Before her first client engagement, she engaged a CA who recommended a company structure with a discretionary trust to protect her personal assets and allow flexible profit distribution as the business scaled.

The CA set up Xero, built a 12-month cash flow model, and showed Sophiethat she could afford to hire a junior account manager in month 9 if revenue stayed on track. That clarity gave Sophie the confidence to invest in growth early, rather than staying solo out of fear.

When You’re Scaling

As you grow, complexity grows with you: multiple entities, staff (payroll tax, super, FBT), inventory or project costing, and related-party transactions between entities. CAs manage this complexity while keeping you compliant.

CAs use management accounting analysis to show you which products or services are most profitable, where costs are creeping, and how to adjust pricing without losing customers. This moves you from “revenue is up” to “here’s why margin is shrinking and what to do about it.”

Whether you’re approaching a bank, angel investors or VCs, CAs prepare investor-ready financials, model different funding scenarios, and advise on how much capital you need and what it will cost (equity dilution, interest, covenants).

Weak financial controls can lead to fraud, errors or cash leakage as you scale. CAs design and implement approval processes, segregation of duties, and reconciliation workflows to protect your business.

Example

A product business grew from $500K in revenue to $3M in two years, adding 8 SKUs and hiring 12 staff. The founder felt busy but wasn’t sure if they were actually profitable. Their CA ran a product-line profitability analysis and discovered one hero product was delivering 60% gross margin, while three newer products were barely breaking even after freight and packaging.

The CA modelled scenarios: discontinuing low-margin products, raising prices by 8%, or renegotiating supplier terms. The founder chose a combination—7% price rise on two products, discontinued one, and locked in better freight rates. Within six months, the overall gross margin improved from 42% to 51%, adding $270K in annual profit, which funded a new warehouse and two additional hires.

When You’re Planning an Exit or Major Transaction

Buyers, investors and lenders will scrutinise your financials during due diligence. A CA ensures your records are audit-ready, your structures are clean, and your numbers tell a compelling, defensible story.

Clean financials, clear separation of owner versus business expenses, strong systems and credible forecasts all improve how buyers perceive risk—and therefore what they’re willing to pay.

CAs advise on timing the sale, structuring it (asset sale versus share sale), and minimising capital gains tax and other liabilities so you keep more of the proceeds.

For family businesses, CAs work alongside lawyers to structure succession in a tax-effective, equitable way that protects the next generation and avoids disputes.

Example

David built a trades business over 15 years, turning over $2.8M with strong recurring contracts. His original accountant handled BAS and tax returns, but never formalised the structure—David was still a sole trader with no separation between personal and business assets.

When an industry competitor approached with a buyout offer, David engaged a CA to prepare for sale. The CA restructured into a company, cleaned up 18 months of financial records, separated David’s personal expenses (previously mixed in), built a normalised EBITDA statement, and prepared a three-year forecast based on contracted revenue.

The buyer’s due diligence was smooth. The clean structure and investor-grade financials increased the offer from an initial $1.9M to $2.8M, and the CA’s tax planning (small business CGT concessions, sale timing) saved David an estimated $180K in tax. David netted $2.62M after costs—$880K more than the original lowball offer, simply because the business was “sale-ready.”

Ethics binds Chartered Accountants.

CAs are bound by CA ANZ’s code of ethics and must act in the public interest, not just for their client or employer. This creates transparency and accountability, and reduces the risk of bad advice or non-compliance.

CA ANZ provides complaints mechanisms, quality reviews and disciplinary processes. If something goes wrong, you have recourse.

CAs must carry professional indemnity insurance, protecting you if errors or negligence cause financial loss.

Many CAs become long-term trusted advisors, understanding your business deeply over the years and providing continuity through different life and business stages—from start-up to scale to exit.

To become a Chartered Accountant, candidates must complete all required educational qualifications, practical experience, and certification steps. This ensures they have the comprehensive training needed to deliver value at every stage of your business.

The bottom line

You don’t need a CA for simple compliance. But when your business reaches a level of complexity, ambition or risk where deeper technical capability and strategic partnership genuinely add value—especially around structuring, funding, exits and decision support—a CA stops being a “nice to have” and becomes a competitive advantage.

Key Takeaways

- A Chartered Accountant is a strategic advisor trained to translate complex financial rules into practical business decisions—not just a compliance professional who files tax returns.

- CAs hold higher authority than general accountants: they can audit financial statements, are bound by CA ANZ’s strict ethics code, and must carry professional indemnity insurance.

- You don’t need a CA for simple compliance, but CA-level expertise matters for multi-entity structures, capital raises, major transactions, and strategic growth planning.

- At start-up, CAs help you choose the right structure (sole trader vs company vs trust), set up compliant systems, and build cash-flow forecasts so you know when you can afford to hire.

- When scaling, CAs identify which products are profitable, optimise pricing and margins, prepare investor-ready financials, and implement controls to prevent fraud and cash leakage.

- For exits, CAs prepare sale-ready businesses with clean structures, audit-ready records and tax-optimised strategies that can add hundreds of thousands to your net proceeds.

- CAs are bound by public-interest obligations (not just client interests), with CA ANZ oversight, complaints mechanisms and mandatory insurance giving you recourse if something goes wrong.

- Match the advisor to the complexity—CA expertise becomes a competitive advantage when your business reaches a level of complexity, ambition or risk where strategic capability genuinely adds value.

Frequently Asked Questions

What is a Chartered Accountant?

A Chartered Accountant (CA) is a finance professional who has completed the Chartered Accountants Australia and New Zealand (CA ANZ) program, which includes rigorous education, supervised practical experience, and ethical training. They are recognised globally and have the authority to audit financial statements, review financial reports, and provide advanced financial advice.

Unlike general accountants, CAs are trained to interpret complex accounting standards, tax legislation and financial regulations, allowing them to provide strategic guidance on structures, pricing, profitability and long-term decision making.

How is a Chartered Accountant different from a general accountant?

A general accountant mainly handles compliance tasks such as bookkeeping, BAS lodgements, and basic tax returns. They are best suited for sole traders or businesses with simple financial needs.

A Chartered Accountant operates at a higher technical level and is qualified to audit financial statements, manage complex structures, interpret accounting standards, and advise on advanced financial strategies. They are bound by strict ethical standards and must carry professional indemnity insurance.

Do all businesses need a Chartered Accountant?

No. If your business is a sole trader or has simple compliance needs, a general accountant or tax agent is usually enough. They can prepare accounts, lodge your BAS and tax return, and keep your records compliant.

A Chartered Accountant becomes necessary when your business grows in size or complexity. Multi-entity structures, trusts, significant transactions, funding applications, or strategic financial decisions benefit from CA-level expertise.

When should a business consider switching to a Chartered Accountant?

You should consider moving to a CA when your financial situation involves multiple entities, employees, trust structures, related-party loans, or complex tax issues. At this point, small compliance mistakes become expensive, and strategic financial guidance becomes more valuable.

You also need a CA when preparing for funding, raising capital, dealing with investors, or planning to sell the business. These scenarios often require audit-ready numbers, technical advice, and modelling that general accountants usually do not provide.

What services do Chartered Accountants provide beyond compliance?

CAs provide advisory services such as pricing analysis, margin optimisation, scenario modelling, cash flow forecasting, business structuring, and funding support. They help business owners make practical decisions based on data rather than guesswork.

They also help prepare audit-ready reports, financial models for lenders or investors, exit strategies, and due diligence. This makes them valuable strategic partners, not just compliance providers.

Can a Chartered Accountant help with setting up a new business?

Yes. CAs are trained to recommend the right business structure based on liability, tax efficiency and growth plans. They help you choose between a sole trader, company, trust, or hybrid arrangement, and set up the right reporting systems from the beginning.

They also help new founders understand their financial statements, build cash flow forecasts, register for tax obligations, and ensure their operations meet ATO expectations from day one.

Why do lenders and investors prefer financials prepared by Chartered Accountants?

Lenders and investors often require reviewed or audited financial statements, which only CAs or CPAs can sign off on. Their training ensures financial information is accurate and compliant with accounting standards.

They also present financial data in a more investor-friendly format, making it easier for lenders to assess risk and for investors to understand profitability. This increases trust and improves approval chances during funding applications.

What ethical standards are Chartered Accountants required to follow?

CAs must follow CA ANZ’s professional code of ethics, which requires them to act in the public interest, not just in the interest of the client. This includes integrity, objectivity, professional competence, confidentiality and professional behaviour.

They are also subject to quality reviews, disciplinary processes, and must carry professional indemnity insurance, giving clients protection and recourse if something goes wrong.

Is a Chartered Accountant better for businesses preparing for a sale or exit?

Yes. During an exit, buyers conduct detailed due diligence and expect clean records, clear structures and reliable forecasts. A CA can restructure your business, clean up accounts, isolate personal expenses, and produce normalised EBITDA figures.

They also advise on tax-effective sale structures, timing, and documentation to maximise net proceeds. Businesses that undergo CA-led preparation often achieve higher valuations during a sale.

Is hiring a Chartered Accountant worth the cost?

The cost depends on complexity. For simple tax returns or BAS, a general accountant is cheaper and often appropriate. But for businesses with multiple entities, growth plans, or major transactions, the value of a CA can far outweigh the fee.

CAs help prevent costly mistakes, optimise profitability, improve financial visibility and increase approval chances for funding. In many examples, the return on investment far exceeds the cost of the service.