BY

|

COVID-19 Small Business Resources Page

Last updated: 14 May 2020

This page will serve as a collation of resources that can assist small businesses and contractors based in Australia who are affected by the COVID-19 pandemic. Due to the uncertain length of the pandemic, we highly recommend you review all of the available information to ensure you have a full understanding of what available support packages are on offer for you to take advantage of.

If you’d like to receive regular updates as information comes to light, you can subscribe to our email newsletter.

💡 Latest News & Updates:

- BNO Tracker for the latest statistical updates

- Johns Hopkins Coronavirus Dashboard

- Testing rate data per capita. Source: Our World in Data

- As of midday, Monday 23 March 2020 – Prime Minister Scott Morrison says parents can keep their children in school, but licensed clubs, pubs, cinemas, casinos, nightclubs and places of worship will close. Source: ABC

- NSW, Victoria, ACT move to comprehensive shutdown of non-essential services amid coronavirus pandemic. Source: ABC

- Western Australia, South Australia to close borders in response to coronavirus pandemic. Source: ABC

- Scott Morrison extends coronavirus restrictions with new limits on weddings and funerals, more business closures. Source: ABC

- Australian Government Official COVID-19 Page

- Rental rescue for business, tenants to be protected from eviction. Source: SMH

- Landlord and Tenant considerations through the coronavirus outbreak. Source: Norton Rose Fulbright Lawyers

- Update to Hospitality Award on 25 March 2020: Hospitality Award flexibility during the outbreak of coronavirus – Schedule L

- Service NSW looking to fill 1000 temporary jobs

- $1.1 billion Medicare, mental health, domestic violence package on its way in response to coronavirus crisis

- Gatherings limited to two people in response to coronavirus pandemic. Source: ABC

- Government to unveil coronavirus wage subsidy for businesses, workers (3rd stimulus package). Source: ABC

- Message +61 400253787 or go to aus.gov.au/whatsapp in your web browser to get #COVID19 information you can trust from the official Australian Government chatbot.

- UPDATE 31/3/20: Changes to the 30% reduced income criteria has been made (see Stimulus Package #3)

- New State Government stimulus packages information added on 2 April 2020

- Cafes, gyms, restaurants to get $10,000 for overheads in NSW (see under NSW State Govt Stimulus Packages). Source: SMH

- JobKeeper eligibility could be broadened as Federal Government vows legislation will pass. Source: ABC

- Boosting Cashflow for Employers’ Calculator added as a free tool (see under Boosting Cashflow for Employers scheme)

- Updated Resources page on Treasury.gov.au. Source: Treasury Australia

💰 Federal Government Support

Watch our video sharing our thoughts on the first stimulus package. Click on the image below.

Stimulus Package #1

On 12 March 2020, the Federal Government rolled out a $17.6bn stimulus package to address the economic impact of COVID-19. This is due to pass through legislation by late March 2020. Below is a summary of information pertinent to small businesses.

Tax Benefits, Not a Cash Grab

The package is designed to provide tax benefits to ensure that concessions for small businesses are being spent in the right places rather than a cash grab. This means that it’s not merely a handout of cash.

What does this mean? It means that in most cases, you’ll need to spend money to get a portion of that back.

We cannot stress this enough – if you’re not making any profit or you are not currently employing any staff or apprentices, then these tax benefits are not going to benefit you a whole lot.

Instant Asset Write-Off Threshold Increase

The instant asset write-off threshold has increased from $30,000 (for businesses with an aggregated turnover of less than $50m) to $150,000 (for businesses with an aggregated turnover of less than $500m) until 30 June 2020.

This requires that you purchase for a capital asset to be able to claim back the tax portion of purchases up to $150,000.

It’s crucial to understand that if you’re not turning a profit in the 2020 Financial Year, then you’re already not paying any or very little tax. In which case, buying an asset won’t provide you with any tax benefits in the short run whatsoever.

🖊️ How to access: you can immediately write off the cost of the asset that costs less than the threshold. Your tax accountant can complete this upon preparation and lodgement of your tax return.

$50,000 Tax-Free Payments for PAYG Withholding

To be eligible for this, you must be an SME that has a turnover of less than $50m that employs staff.

If you’ve got employees between 1 Jan to 30 Jun 2020, you’ll receive a 100% rebate on the PAYG Withholding based on the BAS you’ve lodged. This rebate will be a minimum of $10,000 and up to a limit of $50,000.

A second tax-free, cashback payment of the same amount is available over the June – October 2020 BAS lodgement period.

🖊️ How to access: no need to take further action. The ATO will deliver this as a credit in your BAS system from April 28 2020.

Note: if you are a Director who is taking a “salary” in the form of a dividend or loan, you can look into changing this to a salary to maximise the benefits.

This was revised from 50% rebate to 100% rebate and an increase to a $10,000 minimum up to a limit of $50,000 from the first stimulus package

50% Rebate on Apprentice & Trainee Wages

This is eligible for costs payroll accrued from 1 Jan to 30 Sep 2020.

If you have an apprentice or trainee that you’re paying for, you can claim a wage subsidy of up to $21,000 per eligible apprentice or trainee. This is an excellent benefit if you’re in the industry that currently has or is looking to hire a new apprentice or trainee.

For those of you who aren’t, then take a careful look at the $25,000 PAYG Withholding tax-free benefit above instead.

🖊️ How to apply: Eligible employers can register for the subsidy from 2 April 2020

Factsheet

Australian Apprenticeships: Further Information

Stimulus Payments

A one-off payment of $750 will be paid to social security, veteran and other income support recipients and concession cardholders.

You will need to be eligible between 12 March 2020 and 13 April 2020.

🖊️ How to access: If you are receiving existing income support, no further action is required, and it will be paid to you from 31 March 2020.

Key Takeaways – Review Your Individual Circumstances

As you can see, most of these are benefits for tax or expenses you’ve already paid.

What you need to understand is that the government’s approach is to stimulate spending in the economy. As we mentioned above, for those of you who aren’t going to be turning a profit, these incentives are less likely to offer you any benefits.

However, each business’ situation is different, and we strongly recommend you assess this with your accountant.

Stimulus Package #2

A second stimulus package was announced on 22 March 2020 worth an estimated $66.1 billion.

This particular support package is specifically designed to support:

- Households including casuals, sole-traders, retirees and those on income support

- Assistance for businesses to keep people in a job

- Regulatory protection and financial support for businesses to remain in business

Full press release

Full summary: Treasury

Boosting Cash Flow for Employers Payments from Jan 2020 to June 2020

Note: this has been increased since the first stimulus package.

The Government is providing up to $100,000 in cash to eligible SMEs and NFPs that employ people. The scheme is designed to incentivise employers to retain staff and increased cash flow to continue operating.

The minimum payment for this is $20,000. This payment will come in the form of a credit by the ATO on activity statements from late April.

Under this enhanced scheme, employers will receive a payment equal to 100% of their salary and wages tax withheld (previously 50%). The maximum payment is being increased from $25,000 to $50,000. In addition, the minimum payment is being increased from $2,000 to $10,000.

For the period of July – October 2020 period, eligible entities will receive an additional payment equal to the total of all of the Boosting Cash Flow for Employers payments they have received. This would be at least $20,000 up to a total of $100,000 under both payments.

The scheme is tax-free to employers and is automatically calculated by the ATO. No new forms are required.

Eligibility – Boosting Cash Flow for Employers Payments

SMEs and NFPs with aggregated annual turnover under $50m and employ workers will be eligible. Aggregated turnover is based on prior year’s turnover.

- Payment will be delivered by the ATO in the form an automatic credit in the activity statement system from 28 April 2020 upon employers lodging eligible upcoming activity statements

- Eligible employers that withhold tax on their employees’ salary and wages will receive a payment equal to 100% of the amount withheld, up to a maximum payment of $50,000

- Eligible employers that pay salary and wages but are not required to withhold tax will receive a minimum payment of $10,000

- You must be an active employer prior to 12 March 2020 to be eligible

Eligibility – Additional Payment from Jul 2020 to Sep 2020

Your business must continue to be active.

If you lodge your activity statement monthly, the additional payments will be delivered as an automatic credit in the activity statement system. This will be equal to a quarter of the total initial Boosting Cash Flow for Employers payment following the lodgement of your July 2020, August 2020 and September 2020 activity statements (up to a total of $50,000).

If you lodge your activity statement quarterly, the additional payments will also be delivered as an automatic credit in the activity statement system. This will be equal to half of your total initial Boosting Cash Flow for Employers payment following the lodgement of your July 2020 and September 2020 activity statements (up to a total of $50,000).

Example:

You employ two casual employees who earn $10,000 each per year. In your quarterly BAS, you report withholding $0 for your employees as they are under the tax-free threshold.

Under the Government changes, you’re able to receive the payment on lodgement of your BAS by receiving:

- A credit of $10,000 for the March quarter after paying salary and wages. As they are casual and under the tax-free threshold, no tax is withheld

- An additional payment of $5,000 for the June quarter

- An additioanl payment of $5,000 for the September quarter

🖊️ How to access: As long as you meet the eligibility requirements and lodge your BAS, you will automatically receive the credit refund from the ATO

For more information including the timing of payments: Factsheet

Download our Boosting Cash Flow for Employers Calculator to work out how much you can expect to get

Temporary Relief for Financially Distressed Businesses

A creditor issuing a statutory demand on a company is a common way for a company to enter liquidation. The Government is temporarily increasing the current minimum threshold for creditors issuing a statutory demand on a company under the Corporations Act 2001 from $2,000 to $20,000. This will apply for six months.

Not responding to a demand within the specified time creates a presumption that the company is insolvent. The statutory timeframe for a company to respond to a statutory demand will be extended temporarily from 21 days to six months. This will apply for six months. To assist individuals, the Government will make a number of changes to the personal insolvency system regulated by the Bankruptcy Act 1966.

The threshold for the minimum amount of debt required for a creditor to initiate bankruptcy proceedings against a debtor will temporarily increase from its current level of $5,000 to $20,000. This will apply for six months.

Temporary Relief from Directors’ Personal Liability for Trading While Insolvent

Directors are personally liable if a company trades while insolvent. This can lead to boards of directors feeling under pressure to make quick decisions to enter into an insolvency process if there is any risk that the company will experience periods where it will be trading while insolvent.

To make sure that companies have the confidence to continue to trade through the coronavirus health crisis with the aim of returning to viability when the crisis has passed, directors will be temporarily relieved of their duty to prevent insolvent trading with respect to any debts incurred in the ordinary course of the company’s business. This will relieve the director of personal liability that would otherwise be associated with insolvent trading. It will apply for six months.

Coronavirus SME Guarantee Scheme

The Federal Government will guarantee 50% of new loans issued by eligible lenders to SMEs. The guarantee will be for up to $20bn for $40bn worth of SME loans. For example, if you were to apply for a loan with a lender for $50,000, the government will guarantee $25,000 of that to help you secure the loan.

Note: this does not mean the Federal Government is issuing loans directly. Instead, they are helping banks reduce their risk and increase loan approval processes to SMEs who need working capital

🖊️ How to access: Directly contact your bank or authorised lender as it’s expected that they will roll out a new product directly associated with the Coronavirus SME Guarantee Scheme

Coronavirus Supplement

There will be a temporary expansion of eligibility for income support and a time-limited Coronavirus supplement to be paid at a rate of $550 per fortnight for new and existing recipients of the following:

- JobSeeker Payment

- Youth Allowance jobseeker

- Parenting Payment

- Farm Household Allowance

- Special Benefit

This will be paid for the next six months, and this will be paid on top of income support payments each fortnight.

🖊️ How to claim: Register or claim via your MyGov account. Download a pdf copy of the instructions below if you need to stand down your employees.

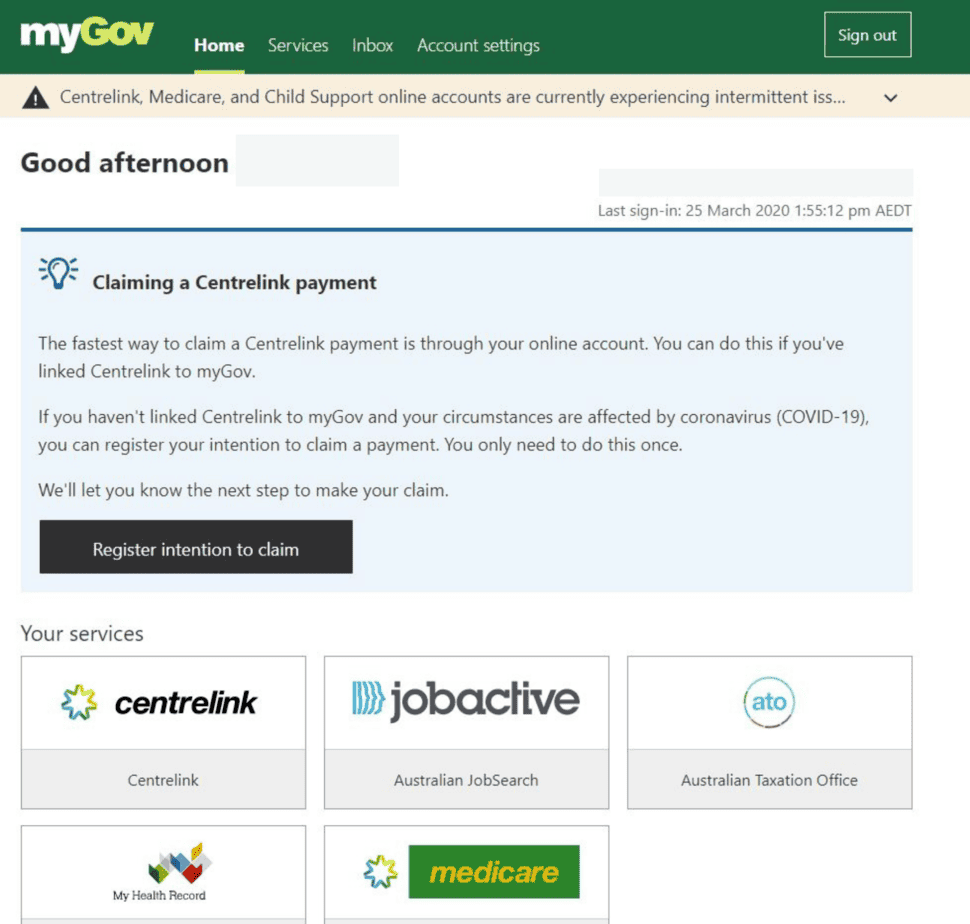

The Government has recently made it easier for you to register for Centrelink as soon as possible. You will now see an announcement when you log in. Follow the steps below:

Step 1 – Select Register intention to claim:

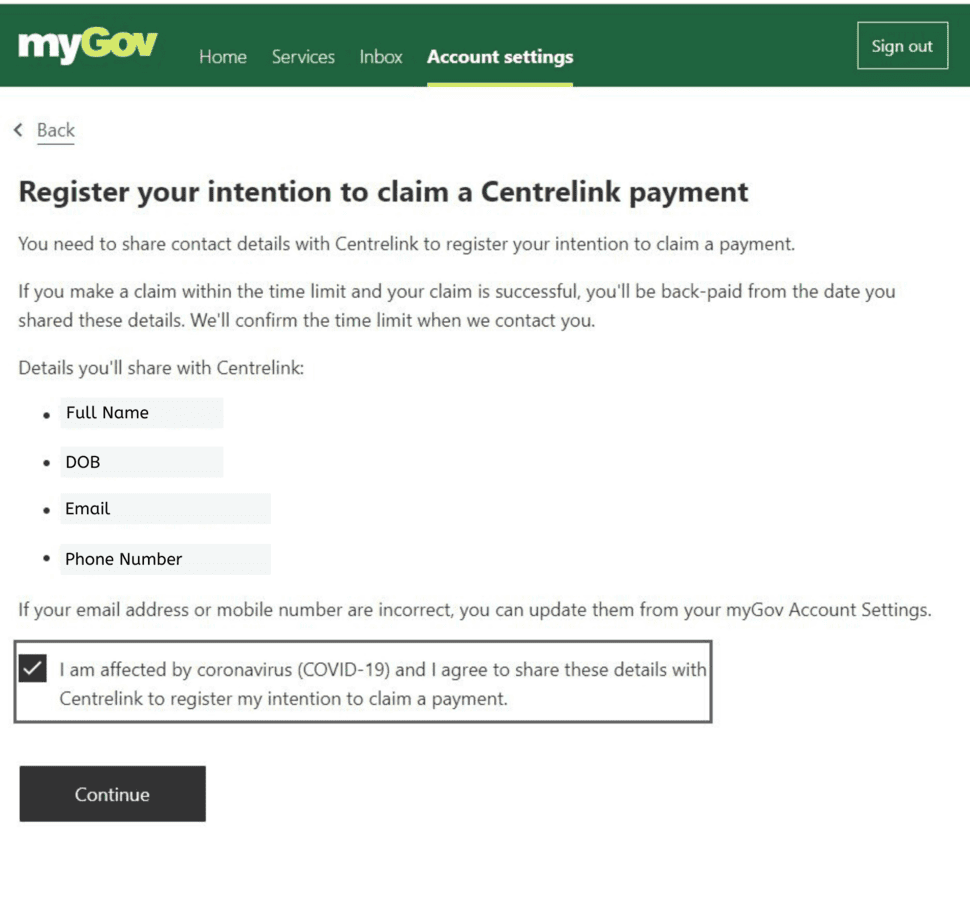

Step 2 – A preview will be given of your contact details. Please check it’s correct before ticking the box and selecting Continue. If your contact details are incorrect, select Account Settings to update your contact details before returning.

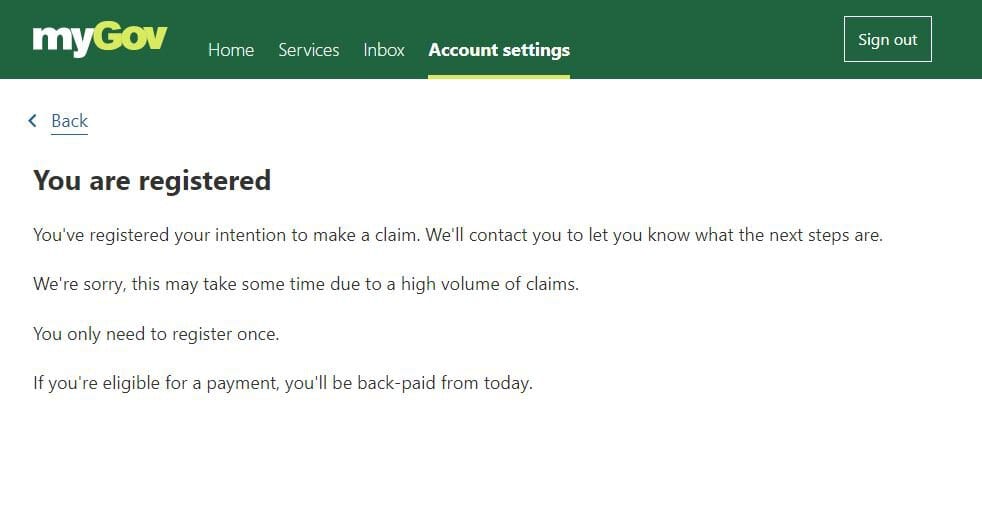

Step 3 – A confirmation message should advise you that your intention has been lodged. Centrelink will now review your registration and it’s estimated that they will notify you by 27 April 2020 whether you qualify for payment. If you do, you will be back paid from the time you have registered your intent to claim:

Final Step – this ensures that your claim will be backdated to the time you registered your intent to claim. You will still need to link your MyGov account with Centrelink and go through the application process with your supporting documents.

The ABC provides a comprehensive set of instructions on how to do this.

Eligibility: Coronavirus: Am I eligible for Centrelink’s Jobseeker payment and does my partner’s income affect it?

Department of Social Services COVID-19 Information Page

Summary of Eligibility. Source: ABC

Downloadable pdf copy of instructions

Further Stimulus Payment

In addition to the $750 stimulus payment announced in the first stimulus package, the Government will provide a further $750 payment to social security and veteran income support recipients and eligible concession cardholders.

This second payment will be made from 13 July 2020.

🖊️ How to claim: If you are receiving existing income support, no further action is required and it will be paid to you from 13 July 2020.

Early Release of Superannuation

Individuals in financial stress due to the coronavirus will be able to access up to $10,000 of their superannuation in 2019 – 20 and a further $10,000 in 2020 – 21. All drawings are tax-free and will not affect Centrelink or Veterans’ Affairs payments.

🖊️ How to apply: All eligible individuals will be able to apply online through their myGov account.

Key Takeaways

This second package looks to plug some of the holes of the first stimulus package.

Stimulus Package #3

A separate JobKeeper Resources page has been created to cover all aspects of accessing the scheme. Visit this page to find out more.

Childcare & Early Childhood Education Relief Package

Additional relief funding has been announced on 2 April 2020 which will involve the following:

- 50% of the child care sector’s fee revenue will be paid by the government up to the existing hourly cap

- The funding will take place from 6 April 2020 based on the number of children who were in care during the fortnight leading up to 2 March 2020

- Payments of higher amounts will be available in exceptional circumstances

- Funding arrangements will be reviewed after one month, with an extension to be considered after three months

New Mandatory Code of Conduct for Commercial Tenants & Landlords

A new code of conduct is set to be released by the Federal Government that binds commercial landlords and tenants. At this stage, this has only been announced and more details are expected to follow.

Key points:

- Binds both landlords and tenants who have a turnover of $50m or less and are eligible for the JobKeeper program

- Landlords will not be permitted to terminate leases or draw on their tenants’ security

- Tenants must honour their leases

- Landlords and tenants must sit down and come to an agreement on moving forward whether it’s a deferral of payment or a waiver to account for at least a 50% of the reduction in turnover

- Landlords that fail to negotiate will lose access to land tax or council rates relief or loan repayment holidays offered by banks. In such a scenario, a tenant would be able to break their lease

- Deferrals to be repayable over remaining terms of the lease or 24 months, whichever is greater

- Any reductions in statutory charges such as land tax or council rates are to be passed onto the tenant

- No interest, fees or any other charges are allowed to be enforced by the landlord with respect to rent waivers, reductions or deferrals

- Landlords will need to agree to freeze rent increases

- Alternative commercial arrangements can be made between landlord and tenants if they both wish to do so

- Code of conduct will be legislated by State and Territory governments

- Residential tenants will be the responsibility of State & Territory governments

Example:

An eligible tenant pays $8,000 in rent per month. They also pay for $500 of cleaning expenses with a lease with 12 months remaining. The business has been affected and closed down with a 100% reduction in turnover, and satisfy the JobKeeper eligibility criteria.

By applying the code:

- The tenant and landlord must agree to new arrangements

- 50% of the 100% reduction will need to be waived i.e. $4,000 of the $8,000 per month

- The remaining $4,000 can be deferred and payable over 24 months, as 24 months is greater than the 12 month period of the lease

- The landlord must pass on any appropriate portion of relief sought by banks or government

- Cleaning outgoings are waived and stopped

💰 State Government Stimulus Packages

NSW

First Stimulus Package

Announced on the 17 March 2020, the NSW stimulus package is a $2.3bn health and economic package.

- $450 million worth of payroll tax waived for businesses with payrolls of up to $10m for the remaining three months of the 2019 – 2020 financial year. This is a saving of a quarter of your payroll tax bill

- Payroll tax threshold increased to $1m for the 2020 – 2021 financial year

- $80m worth of fees and licenses for small businesses, particularly in industries that are worst hit such as hospitality, tourism and trades

- $250m allocated to employ additional cleaning staff to attend to public infrastructure

- $250m worth of maintenance funds to be brought forward to maintain public assets to stimulate additional spending

- $500m worth of capital works and maintenance brought forward

🖊️ How to apply: This will be automatically applied for payroll tax returns covering the remaining three months of the financial year.

Full press release

Info for Small Business Owners – Small Business Commission

NSW Health – Resource for NSW Small Businesses

NSW Fair Trading – Consumer & Business Rights FAQ

Second Stimulus Package

NSW has announced its stage two stimulus package worth $1bn.

- $1bn fund to create businesses and retrain employees

- Deferral of payroll tax for businesses with payrolls over $10m for six months. Businesses with payrolls of less than $0m already received a three-month waiver, but will now get an additional three-month deferral

- Deferral of gambling tax for pubs, clubs, hotels and lotteries for six months on the condition this is used to retain staff

- Deferral of parking space levy for six months

- Deferral of rent in government-owned buildings for commercial tenants with fewer than 20 employees

- $34m to prevent homelessness

- $30m boost to the energy accounts payments assistance scheme

- $10m for charities and $6m for Lifeline

$10,000 Grant for Small Businesses

Small businesses across NSW struggling to cope with the COVID-19 shutdown will receive grants of up to $10,000 under a new NSW government assistance scheme. Eligibility criteria:

- Have between 1-19 employees and a turnover of more than $75,000

- A payroll below the NSW Government 2019-20 payroll tax threshold of $900,000

- Have an ABN as at 1 March 2020, be based in NSW and employ staff as at 1 March 2020

- Be highly impacted by the Public Health (COVID-19 Restrictions on Gathering and Movement) Order 2020 issued on 30 March 2020

- Use the funding for unavoidable business costs such as utilities, overheads, legal costs and financial advice

- Provide appropriate documentation upon application

- Applications for the grant will be available by applying with Service NSW mid-April and will remain open until 1 June 2020

🖊️ How to apply: Gather all information and documentation evidence. You cannot save and resume your application once you’ve started. All applications are made through MyServiceNSW and if your application is approved, payment will be transferred within 10 business days. Click here for further information and to apply.

Six Month Moratorium on Residential Tenancy Evictions

The NSW Government is introducing an interim 60-day stop on landlords seeking to evict tenants due to rental arrears as a result of COVID-19, together with longer six month restrictions on rental arrears evictions for those financially disadvantaged by COVID-19.

Eligibility:

- One or more rent-paying members of a household have lost employment or income due to COVID-19 business closures or stand-downs, or

- One or more rent-paying members of a household have had to stop working or reduce work hours due to illness with COVID-19 or due to carer responsibilities for household or family members with COVID-19, and

- The above factor result in a household income (inclusive of any government assistance) that is reduced by 25% or more

NSW Fair Trading Press Release

VIC

Announced on the 21 March 2020, the VIC stimulus package is worth $1.7bn economic survival and jobs package.

- Full payroll tax refunds for 2019 – 2020 Financial Year for SME with turnover less than $3m (starts 23 March 2020)

- Deferred payroll tax for first three months of 2020/21 Financial Year until 1 January 2021

- Rent relief can be provided for eligible commercial tenants in government buildings

- 2020 land tax deferred

- Government to pay all outstanding supplier invoices within five business days

- Liquor licensing fees are waived for all 2020

- $500m dedicated to a Business Support Fund for the hardest-hit sectors such as hospitality, tourism, accommodation, arts, entertainment and retail

- $500m committed to a Working for Victoria fund to support those who have lost their jobs

- Dedicated hotline setup by Business Victoria for those who need to seek support – 13 22 15

🖊️ How to apply: Contact will be made by the VIC State Revenue Office to all eligible businesses to discuss reimbursement for payroll tax already paid in the financial year

QLD

The QLD government has introduced a recovery package.

- Setup a new Jobs Support loan facility offering $500m in interest-free loans for the first 12 months with loans comprising of up to $250,000. Apply: Link

- Payroll deferment until 31 July 2020 if your business is paying less than $6.5m in taxable wages and your current turnover or profit is directly/indirectly affected by the virus. Apply: Link

- Waived tourism operators and hospitality provider fees

WA

The WA government has introduced a $607m stimulus package on 16 March 2020.

- $114m dedicated to supporting small businesses

- Small businesses that pay payroll tax will receive a one-off grant of $17,500 which will be automatically paid by cheque from July. Recommended that you verify your postal address is correct via Revenue Online: Link

- $1m payroll tax threshold brought forward to 1 July 2020

- Payroll tax payments can be deferred until July 21 2020 for businesses impacted by COVID-19. Apply: Link

A second package worth $1bn was announced including extra assistance for households’ and small businesses’ energy bills that will take effect until September 30 2020.

- Extension of Energy Assistance Payment, no disconnections for power and water

- $502m dedicated to small businesses including reduction in electricity bills license fees waived, and additional payroll tax reliefs

- Electricity bills for small businesses will be reduced, with a one-off $2,500 credit available for Synergy and Horizon Power customerse that consume less than 50 MWh per annum

- Payroll tax waived for a four-month period between 1 March to 30 Jun 2020 for SMEs with annual wages of less than $7.5m in 2019-20

- $100.4m worth of licence fees waived for SMEs for the next 12 months

The WA State Government has also announced that WA businesses will not need to pay payroll tax on Commonwealth JobKeeper payments.

SA

The SA government has introduced a $1bn response package which is inclusive of the initial $350m announced by the government.

- Six-month waiver for all businesses with annual aggregate payroll up to $4m (April – September)

- From July, individuals and businesses with outstanding quarterly bills for 2019-20 land tax are able to defer payments for 6 months

- For 2020-21, Land Tax Transition Relief fund will be increased from 50% to 100% based on existing relief criteria guidelines

- Waiver of liquor license fees for 2020-21 for hotels, restaurants, cafes and clubs forced to close

- $300m Business and Jobs Support Fund established – detailed to be confirmed

- $250m Community and Jobs Fund established – detailed to be confirmed

- Once-off cash payment of $500 for households with unemployed or one member of the family who had lost their job due to the coronavirus

- Public servants with family members who have lost their job and moved onto Commonwealth benefits will receive their accrued leave down to a limit of 2 retained weeks

A second stimulus package worth $650m has been announced which will include $300m for businesses and industries and $250m for community organisations and training.

More to come shortly.

ACT

The ACT government has committed $137m to support businesses and the ACT community.

- $2,622 credit to commercial rates bill

- $750 rebate to small businesses for their next electricity bill

- Businesses that pay up to $10m in wages will be able to defer payroll tax for 12 months

- Industries affected by COVID-19 will receive a once-off six-month waiver on payroll tax

- Taxi and rideshare fees are waived

- Food and liquor licence fees waived

- $20m in funding is allocated for simple infrastructure works on public buildings

- Funding for clubs will be allocated to retain casual staff

TAS

The Tasmania government unveiled a $420m stimulus package.

- The package offers interest-free small business loans of up to $20m for businesses turning over less than $5m

- Payroll tax will be waived for hospitality, tourism and seafood industry for the last four months of 2019 – 2020 Financial Year

- $50m will be allocated to fast track public building maintenance spend over the next 12 months

- The government will improve the speed of paying bills

- $5,000 grants for apprentice and trainee hire in the tourism, hospitality, building and construction, and manufacturing industries

- Payroll rebate for one year via the Youth Employment Scheme for businesses that hire someone 24 and under between April and December 2020

A second stimulus package worth $565m has been announced:

- Government fees to be frozen or waived and capped including water and electricity

- Payroll tax waivers from the first stimulus package to be extended for the entire 2019 – 20 financial year

- Increase of small business interest-free loan scheme from $20m to $50m for businesses with less than $10m in turnover

- Providing a $40m Small Business rants Program with $20m set aside for emergency grants

NT

The Northern Territory government introduced a $65m Jobs Rescue & Recovery Package.

- $20m allocated to the Business Improvement Scheme. Eligible businesses will receive $10,000 and can also receive an additional $10,000 if recipients put in their own $10,000 to incentivise upgrades and purchases for Territory business

- $5m Business Structural Adjustment package for businesses affected by the 100-person rule that limits capacity and revenue generation

- Freezing of Government fees, charges and electricity prices until 1 July 2021

An extra $50m was announced on 24 March 2020 to create a small business survival fund.

🏦 Bank Support

Australian banks have announced that they have introduced a relief package to assist small businesses to survive.

The Australian Banking Association has announced that Australian banks will defer loan repayments for small businesses affected by COVID-19 for six months.

The banks will put in place a fast track approval process. You will need to contact your bank to initiate the process.

- Available to businesses with a turnover of up to $50 mil. Loans under this scheme must be approved by 30 September 2020.

- Max total size of loans = $250,000 per borrower (plus any capitalised interest)

- Loans will be unsecured (i.e. no asset needs to be provided for security). A range of loan types are available e.g. overdrafts & term loans. Credit cards are not eligible. Overdrafts are the recommended – interest only to be incurred on amounts drawn down. If no funds are drawn from the facility, no interest will be charged and the facility retains the flexibility to draw down on funds when the need arises.

- Loans intended to provide for business’ current & upcoming cash flow needs e.g. rent & staff expenses. Loans issued under this Scheme cannot be used to refinance any drawn facilities.

- The loan term is up to 3 years, with a mandatory 6 month repayment holiday. Interest incurred during the 6-month repayment holiday with being capitalised (i.e. added to the loan balance)

- Interest rate – determined by commercial lenders. Once the list of participating lenders is published, should compare options prior to committing to a loan under the Scheme.

Individual bank information below.

CBA

- Deferring repayments on a variety of business loan and overdraft products for six months

- Commercial interest rates to be reduced by 0.25

- Merchant terminal fees for impacted customers will be waived for 90 days

- Early redraw fees will be waived on business term deposits (including Farm Management Deposit accounts)

- Establishment fees and excess interest on Temporary Excess products waived

- Repayments on vehicle and equipment finance loans will be deferred with tailored restructuring options to be provided to suit individual needs

- No establishment or account fees

- No repayments required for 6 months

- 4.5% pa interest rate

- Principal & interest repayments will apply after initial 6 month repayment holiday

- Includes online redraw capability i.e. customers will only pay interest on drawn balances.

🖊️ Contact & Information: Commonwealth Bank or call 13 2221 from 6am to 10pm

Westpac & St. George

- Continuation of the hardship assistance program

- Deferral of business loan repayments for up to six months but will be assessed on a case-by-case basis

- 6-month payment deferral with interest capitalised

- No establishment fees or monthly account keeping fees – other fees & charges may apply

- Interest rate not stated

🖊️ Contact & Information: Westpac or call 1800 067 497 & St George

ANZ

- Interest repayments are suspended

- Deferral of business loan repayments for up to six months but will be assessed on a case-by-case basis

- Early redraw fees will be waived on term deposits

- Access to additional credit subject to approval

- No offer in providing unsecured loans of up to $250k. Only drop in interest rates and deferred loan repayments for existing business loans, as well as temporary increases in overdraft facilities for 12 months.

🖊️ Contact & Information: ANZ

NAB

- Deferral of business loan repayments for up to six months but will be assessed on a case-by-case basis

- Extension of business loan term period by up to three months on a case-by-case basis

- Assistance in existing business loan restructuring, including equipment finance

- Business credit card payments deferred

- NAB has announced a Business Support Loan. for NAB SME customers for a new low-rate loan up to $250,000 at 4.5% p.a. with no repayment requirements for the first six months. To be eligible, businesses must have an annual turnover of less than $50m.Important information

– Open to new and existing NAB business customers – new applications only

– Loans must be for business purposes

– Loan term up to three years

– Principal and interest repayments will apply only after the initial six month repayment holiday

– No application or loan services fees will apply

– Loans will be available until 30 September 2020

– No broker commissions will be payable on the NAB Business Support Loan - 4.5% p.a with no repayment requirements for the first 6 months.

- Loan term up to 3 years

- Principal & interest repayments will apply after the initial 6 month repayment holiday

- No application/loan service fees

🖊️ Contact & Information: NAB or call 13 10 12

Other Banks

🧾 ATO Support

The ATO has offered an emergency support infoline on 1800 806 218 for businesses that are in distress.

You’ll be able to speak to an ATO agent who can tailor a solution for your circumstances.

As a small business accounting firm, we have been applying for payment deferrals and lodgements until the end of July 2020 for outstanding tax liabilities.

If your business is currently experiencing financial difficulty, we encourage you to speak to your tax agent and do the same.

Relief options:

- Large business relief

- Payment deferrals of up to 4 months for BAS, FBT, excise and income tax assessments

- Monthly GST credits instead of quarterly to access after GST refunds if entitled to it

- PAYG instalments can be varied down to zero for the March 2020 quarter and also claim a refund for any instalments for September 2019 and December 2019 quarter

- Remitting interest and penalties incurred on or after 23 January 2020 for tax liabilities

- Low-interest payment plans can be setup for businesses in financial distress for existing or ongoing tax liabilities

Note:

- Super guarantee payments still must be made

- The ATO is also offering wellbeing support

🖊️ How to access: These options are not automatically applied and will require that you contact the ATO on 1800 806 218.

ATO Business Support Page

ATO COVID-19 FAQ for Businesses

New Simplified Method for Claiming Working from Home Deductions

The ATO has announced a simplified method of calculating expenses in relation to individuals working from home due to COVID-19.

All running expenses incurred during the period 1 March 2020 to 30 June 2020 can be calculated based on a rate of 80 cents for each hour an individual carries out genuine work duties from home. This includes:

- Electricity

- Cleaning costs for your dedicated working area

- Phone and internet expenses

- Computer consumables and stationery

- Depreciation of home office furniture and furnishings (office desk, chair etc.)

- Depreciation of home office equipment (computers, laptops, printers etc.)

If calculating based on the new method, separate claims cannot be made for any of the above running expenses.

In addition:

- There are no requirements to have a separate or dedicated area at home set aside for working

- Multiple individuals living under the same house can claim under this method; and

- Records will only need to be recorded for the period of 1 March 2020 to 30 June 2020.

All other working from home running expenses that are incurred prior to 1 March 2020 must use existing claim arrangements and record keeping.

Further information: ATO Website

⚖️ COVID-19 & Australian Workplace Laws

Update 25 March 2020: FairWork Australia has made some changes to the Hospitality Award empowering Employers with greater flexibility to re-purpose staff duties/responsibilities as well as the ability to reduce their hours with prior notice and consultation. For a full list of the changes, please click here.

Some common questions:

What if an employee cannot attend work because their child’s school or childcare centre has closed due to coronavirus?

Employees who cannot come to work because they need to care for a child whose school or childcare centre has closed will ordinarily need to use paid leave entitlements to be paid for their absence, or make alternative arrangements with their employer to work from home or a suitable solution. More information here

Can an employer change an employee’s regular roster or hours of work?

Employers must consult with employees about any changes to their regular roster or hours of work under their award or enterprise agreement.

When can employees be stood down without pay?

Fair Work Australia encourages that you try and find a solution between employee and employer.

Under the Fair Work Act, an employee can only be stood down without pay if they cannot be usefully employed because of a stoppage of work for any cause for which the employer cannot reasonably be held responsible for.

What if an employee is stuck overseas or needs to self isolate?

There is no specific law that addresses this situation. However, employees should contact their employers as soon as possible and come to their own arrangements.

If an employer directs an employee to self-isolate or stay home in line with government and health advice, and the employee isn’t sick with the coronavirus, the employee should be ordinarily paid for this.

If an employee cannot work due to travel restrictions or self-isolation requirements as a result of enforceable government order, employers are not obliged to pay them. An employee can use paid leave during this period.

What if an employee wants to stay home as a precaution?

If your employee isn’t directed by a government authority or the employer to remain at home, the employer and employee will need to make an arrangement such as working from home or taking paid leave.

What if an employer wants their employees to stay home as a precaution?

If an employer deems that an employee working is risky to work health and safety, if the employee is deemed ready, willing and able to work, then the employee should be entitled to be paid during this period.

What if an employer needs to let employees go?

If an employer needs to make an employee redundant, they may be eligible for redundancy pay according to the Fair Work Act. It also requires employers to meet with employees before they can terminate an employee’s employment, such as proving notice.

What about casual staff or contractors?

Unfortunately, casual staff don’t have paid sick leave or carer’s leave entitlements. Employers and casual employees need to consider each party’s obligations and rights under any applicable enterprise agreement, modern award, employee contracts or workplace policies.

Independent contractors are not employees and do not have paid leave entitlements under the Fair Work Act. Special provisions do exist for specific industries in textiles, clothing and footwear.

What if my business is affected by a lockdown?

Under the Fair Work Act, an employer cannot reasonably be held responsible for having to stand down an employee without pay due to stoppage of work. In the case of a lockdown, this is a government order and out of the control of the employer.

🖊️ For more information:

Fair Work Australia information

SafeWork Australia – Advice for Employees

State or Territory WH&S Websites

SmartTraveller for Employees Returning from Overseas

📱 National Support Networks

- Lifeline: 13 11 14

- Suicide Call Back Service: 1300 659 467

- Beyond Blue: 1300 224 636

- Mental Health Line: 1800 011 511

- Kids Helpline: 1800 551 800

- Mensline Australia: 1300 78 99 78

- GriefLine: 1300 845 745

📦 Box Advisory Services Recommended Business Strategy

We have received a significant number of enquiries with regards to what you should do in the event of a lockdown, what to do with employees, and how to cushion your business from this impact.

The strategy we recommend is formulated on the premise that there is an extended period of lockdown where your business will be impacted and unable to trade. Therefore, the goal is to maximise your cash flow and liquidity to ensure that your business can survive until the lockdown concludes.

We highly recommend you take a proactive approach and avoid delaying these actions. Do not wait for the red light to be blinking in your proverbial cash flow fuel tank to initiate these conversations as it can be too late.

Disclaimer: This is general advice in nature and we still highly recommend that you speak to an accountant to assess individual risk and strategies

- Defer all tax liabilities with the ATO until after July 2020 (see ATO Support)

- Reduce staff hours and for those you can’t, re-purpose your staff’s role and responsibilities (See COVID-19 & Australian Workplace Laws)

- Contact your banks to defer loan repayments for six months (see Banks Support)

- Apply for any additional loans for working capital that you may need

- Contact your landlord or agent to discuss and negotiate a temporary reduction in rent. Download our email template

- Defer any further payments such as utilities and ongoing services

- Assess where you can take advantage of federal and state government subsidies to make decisions on retaining or standing down staff

📄 Workplace & Community Posters

World Health Organisation

Department of Health

NSW Government Health Department

VIC Government Health Department

QLD Government Health Department

💻 Remote Work Resources

Businesses that can work from home are urged to do so to ensure business continuity. We understand that this may be the first time for many businesses.

As a small business that has been remote working for the past two years, here are some resources to help you get started.

Articles:

- Tips for Managing a Remote Workforce – LinkedIn

- Zapier is a 100% distributed company with over 300 employees in 17 timezones and 28 countries. Here’s their guide to working remotely.

- Small Business Apps that we (Box AS) use

- Best remote working tools

- GitLab, another distributed company and their guide to embracing remote work

- Intense Minimalism’s Guide to Remote Work in the wake of COVID-19

- Slack HQ’s Manager Manual for Remote Work

Recommended Tools:

- Asana, Trello or Monday.com – Project & Task Management

- Slack or Twist – Team Chat and Communication

- Xero, MYOB, QuickBooks or Wave – Cloud Accounting

- Zoom or Google Hangouts – Video or Audio Chat

- LastPass or 1Password – Secure Password Management

- Dropbox or Google Drive – Cloud Storage

- Slite – Documentation and SOP Solution

- Hubstaff – Time Tracking & HR

- Zapier – Automation

- Evernote or Roam – Note Taking

- Teamviewer – Remote Access

📜 Upskilling & Job Search

Have you had to close your business or had your revenue reduced and looking to pick up another revenue stream?

Below is a list of places you can upskill:

- CXL is an award-winning digital marketing company who are offering a free mini-degree for anyone who’s been impacted by the pandemic

- Skillshare – 2 months free trial for first-time users

- 450 Ivy League courses that are free

- Moz Academy has now opened up their courses to be 100% free if you’re interested in getting into SEO marketing

And remote work opportunities:

Box Advisory Services are a team of small business and contractor accountants with the aim to provide business owners high-quality, affordable service. If your business is in distress, you can seek assistance with us with a no-obligation free consultation. Book your appointment today.