BY

|

How to Save $1,000s with FBT Exemptions

Each year, there are possible FBT exemptions for business owners who decide to spend money on corporate gifts or organise a work Christmas party for their employees or clients (or accountants!).

Also, there are implications on GST and tax deductions, if not managed carefully.

However, a little consideration on how best to manage these corporate gift purchases and work Christmas parties can help reduce your tax liability.

In this article, I’ll guide you through on how to maximise your gifting options while minimising potential tax costs.

What is Entertainment for FBT Exemptions?

It’s important to understand the ATO’s definition of what “entertainment” is when it comes to FBT exemptions with corporate gifts and work Christmas parties. Entertainment can include providing:

- Food, drinks or recreation

- Accommodation or travel in connection to such entertainment, or

- Reimbursement or payment of the above two points

Some examples may include:

- Corporate social functions such as work Christmas parties, farewells, birthdays, celebrations

- Gym membership

- Golf days

- Theatre or movie tickets

- Harbour cruise

Why is Entertainment Taxable and Not Considered an FBT Exemption?

The ATO sees this as a way for employers to provide benefits to their employees or clients in a non-monetary method that may be exploited as a loophole in avoiding otherwise payable income tax.

Therefore, unless it is considered “minor or irregular”, regular entertainment or benefits must be reported with an FBT rate of up to 47% of the grossed-up value of the entertainment.

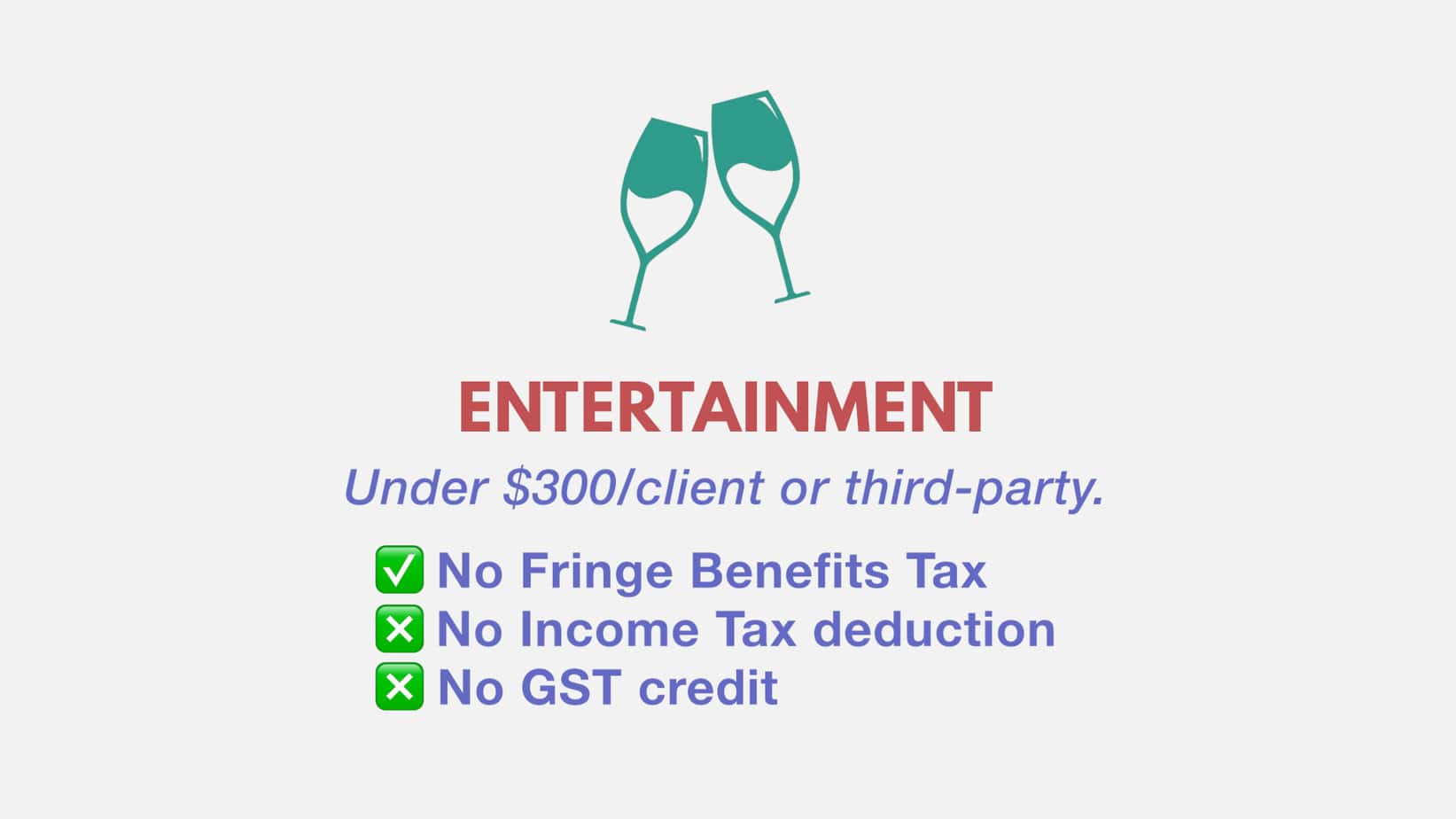

Christmas & Corporate Parties with FBT Exemption

The ATO has outlined that expenditure of $300 or more per person on entertainment, such as work Christmas or corporate parties, will mean that this is liable for FBT, i.e. no FBT exemption.

This includes spending on employee associates, such as spouses or family members.

The best way to be FBT exempt is to spend under $300 as it is considered “minor and infrequent”.

However, if you are FBT exempt then the expense is not tax-deductible nor can GST be claimed on it.

On the other hand, if you spend over $300 and are not FBT exempt, then you can claim a portion of this expenditure as a tax deduction and on GST.

Save thousands with our guide on Small Business Depreciation

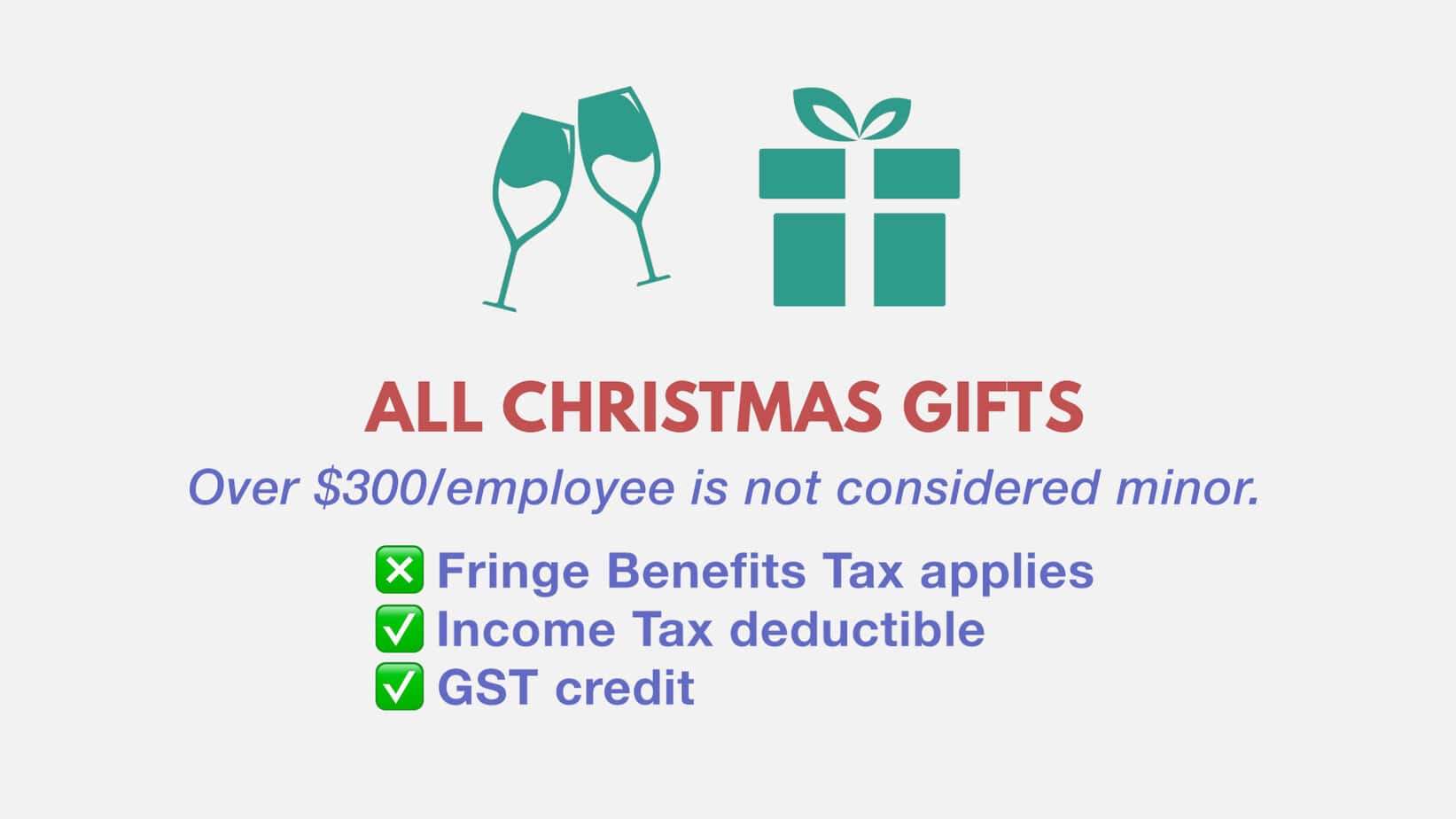

Christmas & Corporate Gifts with FBT Exemption

Corporate gifts or gifts during Christmas to staff generally fall under two categories: entertainment gifts and non-entertainment gifts when it comes to FBT exemption.

For gifts that are considered non-entertainment such as spirits, wine, groceries, food hampers, flower arrangements, plants or gift cards, the following rules apply:

- If it is under $300, then it can be tax-deductible, GST claimable and qualify for FBT exemption

- If it is over $300, then it can be tax-deductible, GST claimable but FBT is not exempt

For gifts that are considered entertainment such as theatre tickets, movie tickets, sporting tickets, golf days, gym membership, the following rules apply:

- If it is under $300, then it is not tax-deductible nor GST claimable but qualify for FBT exemption

- If it is over $300, then it is tax-deductible, GST claimable but FBT is not exempt

Key Takeaways

As mentioned at the beginning, it’s essential to have considerations when planning corporate gifts or parties concerning FBT exemption rules.

A little careful planning can avoid FBT and maximise your tax deduction and claiming on GST.

However, while it’s essential to be aware of this, we recommend that you’re not basing your entire spending decision on aiming for FBT exemption by making the appropriate choices for rewarding your employees or your clients for supporting your business throughout the year.

It’s recommended that if you are unsure of what direction to take on your spending that you consult a tax agent to help you assess your situation.

Box Advisory Services can assist and guide your options with spending on corporate gifts and Christmas parties. To find out more, book a free 45-minute initial consultation with us today.

Sign up to our monthly newsletter where we share exclusive small business and contractor advice!

Disclaimer:

Please note that every effort has been made to ensure that the information provided in this guide is accurate. You should note, however, that the information is intended as a guide only, providing an overview of general information available to contractors and small businesses. This guide is not intended to be an exhaustive source of information and should not be seen to constitute legal or tax advice. You should, where necessary, seek your own advice for any legal or tax issues raised in your business affairs.