BY

|

Managing and Paying Off Your HECS Debt Efficiently

For many Australian graduates, HECS-HELP debt is a big financial burden that needs to be managed. The Australian Government supports the HECS-HELP loan scheme, which helps students cover their course fees.

With recent changes to indexation rates and repayment thresholds, understanding your student loan is more important than ever. This guide will give you the knowledge and strategies to navigate and pay off your HECS-HELP debt.

What is HECS-HELP Debt?

The HECS-HELP system is a key part of the Australian higher education landscape, allowing students to defer their tuition fees until they reach a certain income threshold under the Higher Education Loan Program (HELP). Note that HECS-HELP is different to other student loan schemes like FEE-HELP in terms of eligibility and repayment rules.

The student contribution refers to the payments made by students for their courses, which can be funded through HECS-HELP loans, either fully or partially upfront. As a borrower, you should know the lifetime borrowing limit for HECS-HELP which is the total amount you can borrow over your lifetime.

Eligibility and Repayment Basics

To be eligible for a HECS-HELP loan, students must meet specific criteria. Firstly, they need to be an Australian citizen, a permanent humanitarian visa holder, or a New Zealand citizen who meets the residency requirements. Additionally, they must be enrolled in a Commonwealth-supported place (CSP) at an eligible higher education provider.

Repayment of a HECS-HELP loan is managed through the Australian taxation system. The amount you need to repay each year is based on your repayment income, which is calculated by adding your taxable income, total net investment loss, total reportable fringe benefits amounts, reportable super contributions, and exempt foreign employment income.

The Australian Taxation Office (ATO) is responsible for managing HELP debt, including applying annual indexation to your debt balance. You can check your HELP debt balance through the ATO website or the myUniAssist website to stay informed about your current debt status.

How does HECS-HELP Debt Accumulate?

As you go through your studies, your tuition fees are added to your HECS-HELP debt balance. You may also incur loan fees and be indexed.

To give you an idea, the average HECS-HELP debt in Australia for the 2023–2024 financial year was approximately $27,000, reflecting a slight increase from $26,494 in the 2022–2023 financial year. This increase aligns with changes in indexation rates and reforms to the system.

Compulsory Repayments: Thresholds and Rates

One of the keys to managing your HECS-HELP debt is understanding how compulsory repayments work through the taxation system. These repayments are triggered once your income exceeds a specified threshold, and it is crucial to ensure accurate withholding from employers to cover this liability.

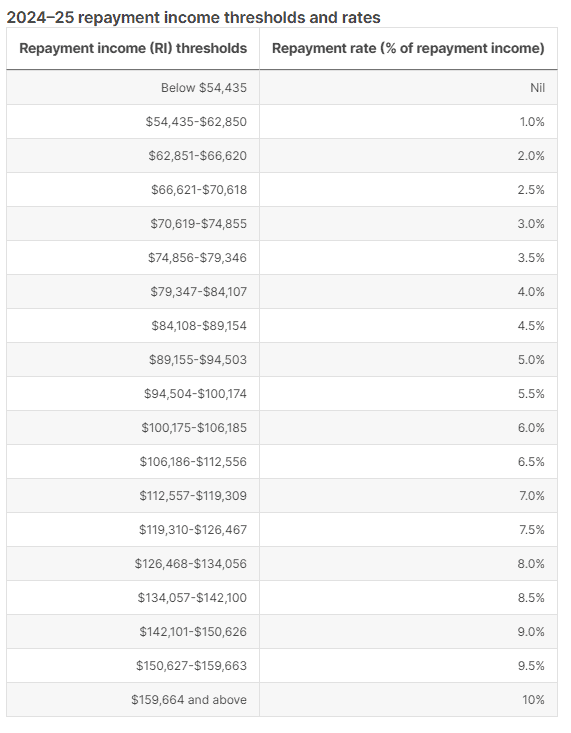

Here are the current repayment rates for 2025:

*Repayment income is your taxable income plus any net investment losses, total reportable fringe benefits, and exempt foreign employment income. SOURCE.

Knowing Your Repayment Obligations

Understanding your repayment obligations is incredibly important to avoid any penalties or fines. These repayment thresholds and rates for study and training loans are updated annually, and you can find the current thresholds and rates on the Australian Government’s website.

The repayment income thresholds determine the amount of compulsory repayment you need to make.

However, you can also make voluntary repayments to the ATO at any time, which can help reduce your overall debt faster. Keep in mind that the ATO will apply indexation to your debt each year, which may affect the total amount you owe.

Should You Make Voluntary Repayments to Pay Off Your HECS Debt Early?

The decision to pay off your HECS debt early is a personal one that depends on many factors. On one hand paying off early can save you on indexation charges and give you peace of mind from debt. But you need to weigh the opportunity cost of using those funds elsewhere, such as investing or saving for other financial goals.

Before paying off early, assess your overall financial situation and consider the interest rates on any other debts you may have. Engage the services of a financial accountant or advisor – like us – to get tailored advice for your situation.

Strategies to Manage HECS-HELP Debt

While HECS-HELP debt may seem overwhelming, here are some practical strategies to reduce the burden:

- Make voluntary repayments when you can: Even small extra payments can add up over time.

- Budget to make repayments: Include your HECS-HELP obligation in your monthly budget to stay on track.

- Use tax refunds to pay down debt: Consider using a portion of your tax refund to make a lump sum payment towards your HECS-HELP balance.

- Stay informed about indexation rates and repayment deadlines: Check regularly to plan ahead and avoid surprises.

Tax Implications and Exemptions

HECS-HELP loans come with certain tax implications that you should be aware of. For instance, the loan is considered a tax-deductible expense, and you can claim the interest on your loan as a tax deduction. This can potentially reduce your taxable income and the amount of tax you need to pay.

Additionally, there are exemptions and benefits that may apply to your HECS-HELP loan. For example, you might be eligible for the Australian Government’s Education Tax Refund, which can provide further financial relief. It’s important to explore all available options to maximise your benefits.

Avoiding Debt Traps

To avoid falling into debt traps, carefully consider your financial situation before taking out a HECS-HELP loan. Make sure to make timely repayments to avoid any penalties or fines.

One effective strategy is to make voluntary repayments to the ATO, which can help reduce the amount of debt you owe. Staying informed about changes to repayment thresholds and rates is also crucial, as these changes can impact your repayment obligations.

Seeking Help and Support

If you find yourself struggling to repay your HECS-HELP loan, don’t hesitate to seek help and support. The Australian Taxation Office offers various resources and tools to help you manage your debt, including online calculators and repayment estimators.

You can also seek personalised advice from a financial advisor, who can provide guidance on managing your debt effectively. Additionally, your university or higher education provider may offer assistance with your loan repayments, so be sure to reach out to them for support.

Impact on Your Financial Goals

It’s important to understand how HECS debt impacts your overall financial situation. Recent government reforms aimed at alleviating the financial burden of student debt on younger generations have been introduced to provide substantial financial relief.

When applying for a home loan, for example, lenders will take into account your HECS-HELP repayments when assessing your borrowing capacity. Your effective tax rate will also be higher due to the HECS repayments taken off your income.

Balancing student loan repayments with other financial priorities requires planning and in some cases professional advice.

Special Circumstances and Exemptions

Life can take unexpected turns and the HECS-HELP system recognises this. If you find yourself unable to work due to illness or disability and your income is below the repayment threshold you will not be required to make compulsory payments. However, indexation will still apply to your debt balance.

For part-time workers or juggling family responsibilities it’s important to stay informed about your options and seek advice from relevant government agencies if needed.

Future Changes and Policy Updates

As with any government program, the HECS-HELP system is subject to review and change. Recent changes to indexation rates for example have significant implications for borrowers. Stay informed about potential reforms such as increasing the repayment threshold or reducing indexation rates.

Key Takeaways

- To manage your HECS-HELP debt effectively you need to be proactive, informed and understand how the system works.

- Stay informed about policy changes, make smart repayment decisions and seek advice when you need it and you’ll be in control of your student loan burden and on track to a brighter financial future.

- Don’t go it alone. Government resources and financial experts are available to help and provide advice tailored to your situation.