BY

|

Fundamentals on How to Buy or Sell a Business

Are you looking to buy or sell a business and not sure where to start?

In this article, I’ll go through some of the fundamental concepts you should know about buying or selling a business so that it can get you off in the right direction.

Introduction

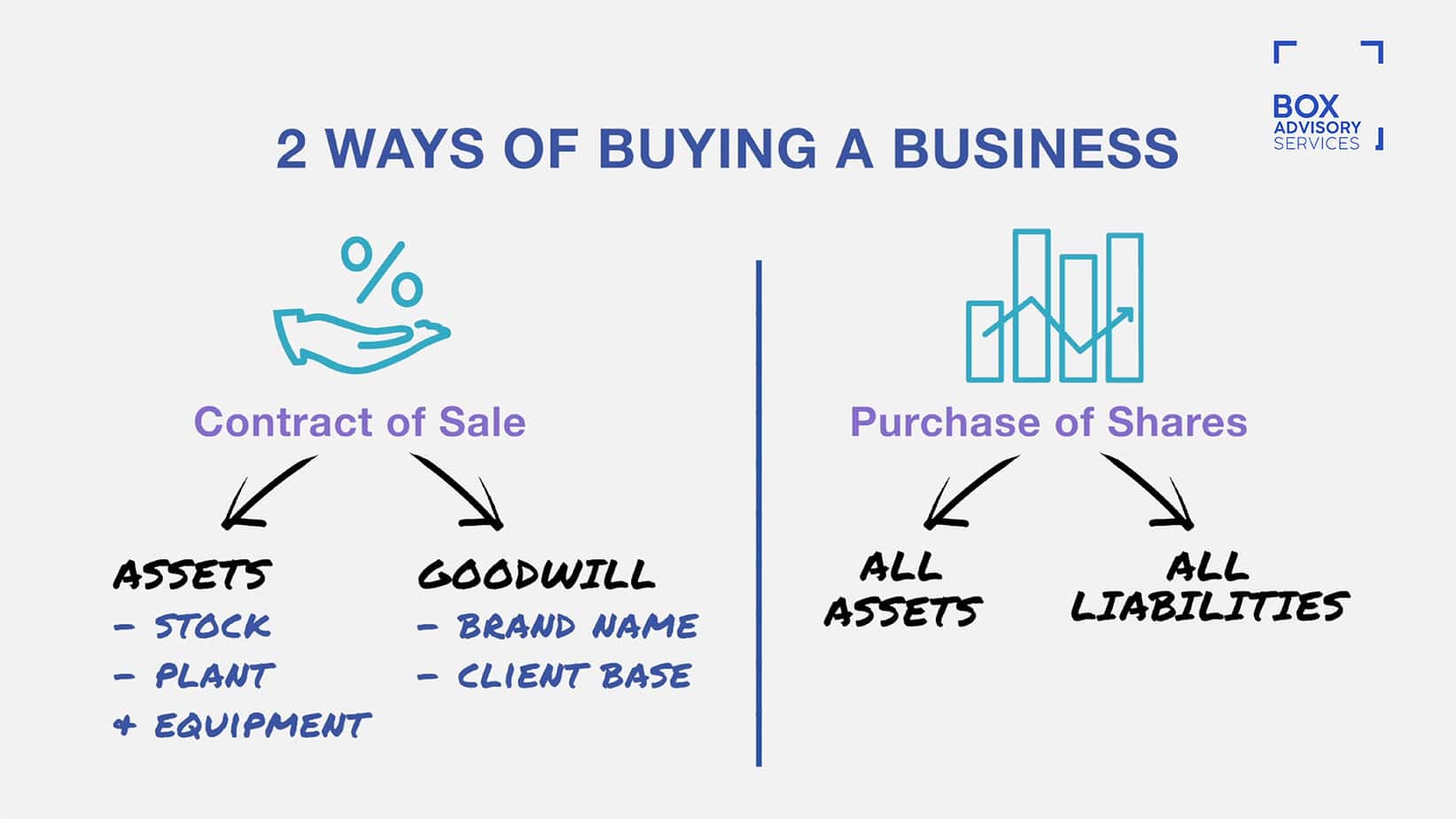

There are some important considerations that need to be made in the purchase of a business. Often times, a business in a form of a company can be sold either for its assets or as a share sale – a distinction you need to take to figure out what is most suitable for your situation.

Share Sale

A share sale of a business, as the name implies, refers to purchasing shares in the company rather than just the assets. You, as the buyer, are essentially purchasing the entity along with all of its assets and liabilities.

Asset Sale (Contract of Sale)

An asset sale or contract of sale refers to the buying or selling of a business’ assets. This may include some of the following:

- Plant and equipment

- Land

- Machinery

- Goodwill

- Intellectual property (such as trademarks and domain names)

- Contracts

In asset sales, the seller would still retain ownership of the business entity should they elect to do so.

Advantages & Disadvantages of an Asset Sale

Buyer Advantages of Asset Sales

An asset sale or contract of sale is often referred to as pro-buyer as it poses low risks and affords prospective buyers to cherry-pick assets of a business that are most valuable whilst discarding the unwanted assets or liabilities. The liabilities of the business can be chosen to remain with the seller and not be transfered over to the new owner.

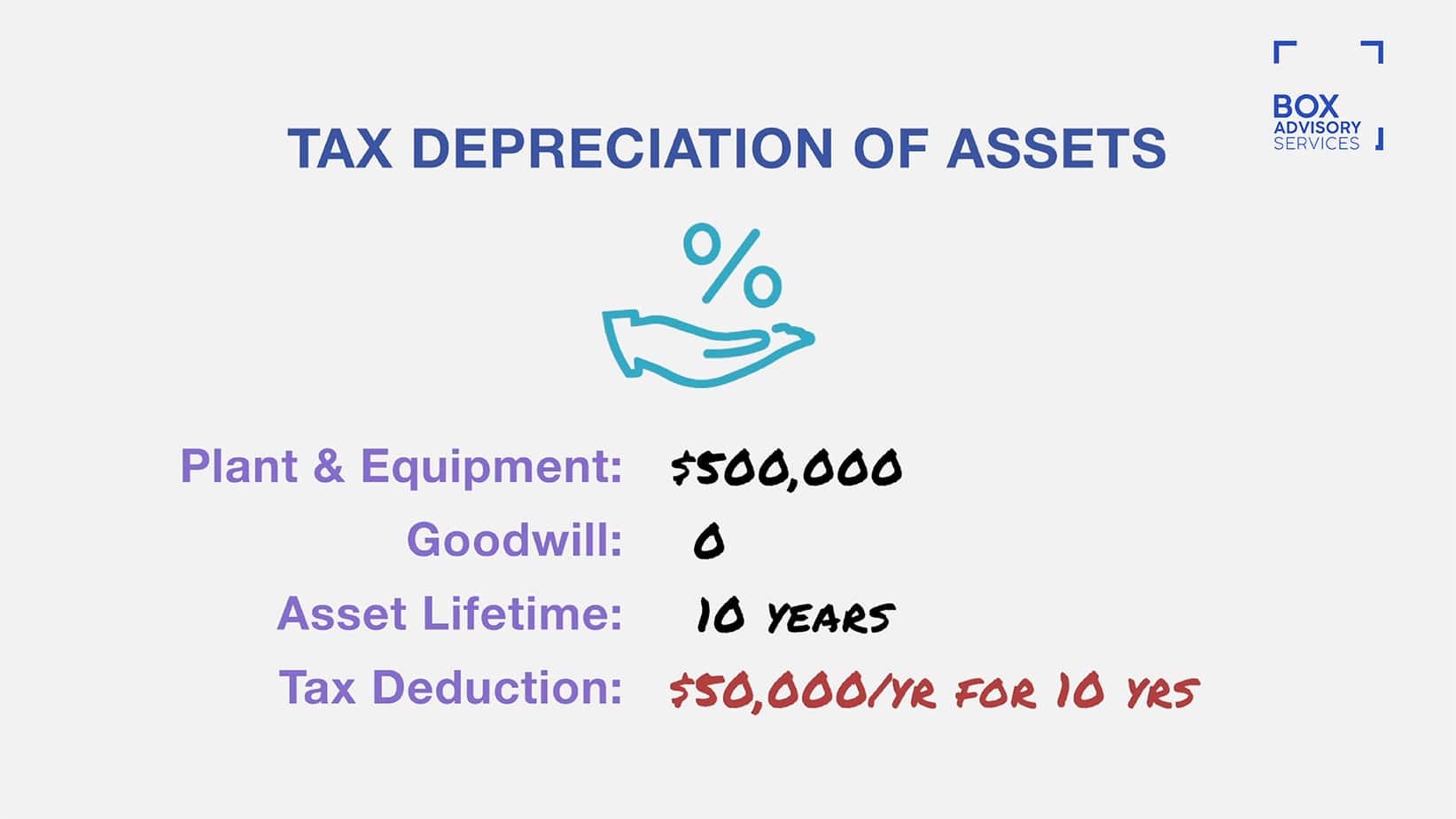

From a taxation perspective, a buyer has the advantage of valuating some assets during the purchase such as plant and equipment that would be beneficial when it comes to claiming depreciation as a tax deduction on these assets.

Buyer Disadvantages of Asset Sales

Although there aren’t too many downsides to purchasing the assets of a business, there are situations such as government licences and permits that cannot be transferred. In addition, in the case of purchases of land or property, stamp duty may be involved in the purchase.

If a business also has existing contracts with third parties, there can sometimes be complications with novating contracts with the buyer if the third party refuses to offer this. In the case of employee contracts, these are not transferrable in an asset sale and must be renegotiated.

Seller Advantages of Asset Sales

Sellers tend to be able to exclude any assets they are unwilling to sell or do not intend to be transferred. In addition, the seller also has fewer liabilities with warranties and indemnities for the assets transferred.

Seller Disadvantages of Asset Sales

Similar to the disadvantages of buyers in asset sales, transferring existing contracts and assets to a new owner may require the consent and involvement of third-parties. This can either be a slow and difficult process if these third parties do not agree to assign the contract to the new buyer. In addition, liabilities of the business still generally remain with the seller if the buyer is not taking on such liabilities. The sale of the assets of the business can result to the owner be left with a shell company and can be costly to close down.

You might also be interested in our Essential Tax Guide on Property Investing

Advantages & Disadvantages of a Share Sale

Buyer Advantages of a Share Sale

In cases where the business has recognised brand, goodwill and reputation, it is advantageous for buyers to buy the business as a share sale to take advantage of this asset. Given that the purchase of a business is in its entirety, any existing contractors would not need to be reassigned and therefore, no third party consent is required. By taking over the company, you also manage to keep the history of the company which can be advantageous as many third party stakeholders such as banks, insurance companies, finance and contractors would prefer to deal with companies with a long term reputation. GST and Stamp Duty is normally exempt or not payable in the purchase of shares.

Buyer Disadvantages of a Share Sale

The risk in buying shares in a business lies in the unknown – as a buyer, you are taking on all past, present and future risks and liabilities of the business. To mitigate this, a buyer must engage in extensive due diligence to ensure that all risks associated with the business are identified and addressed.

Seller Advantages of a Share Sale

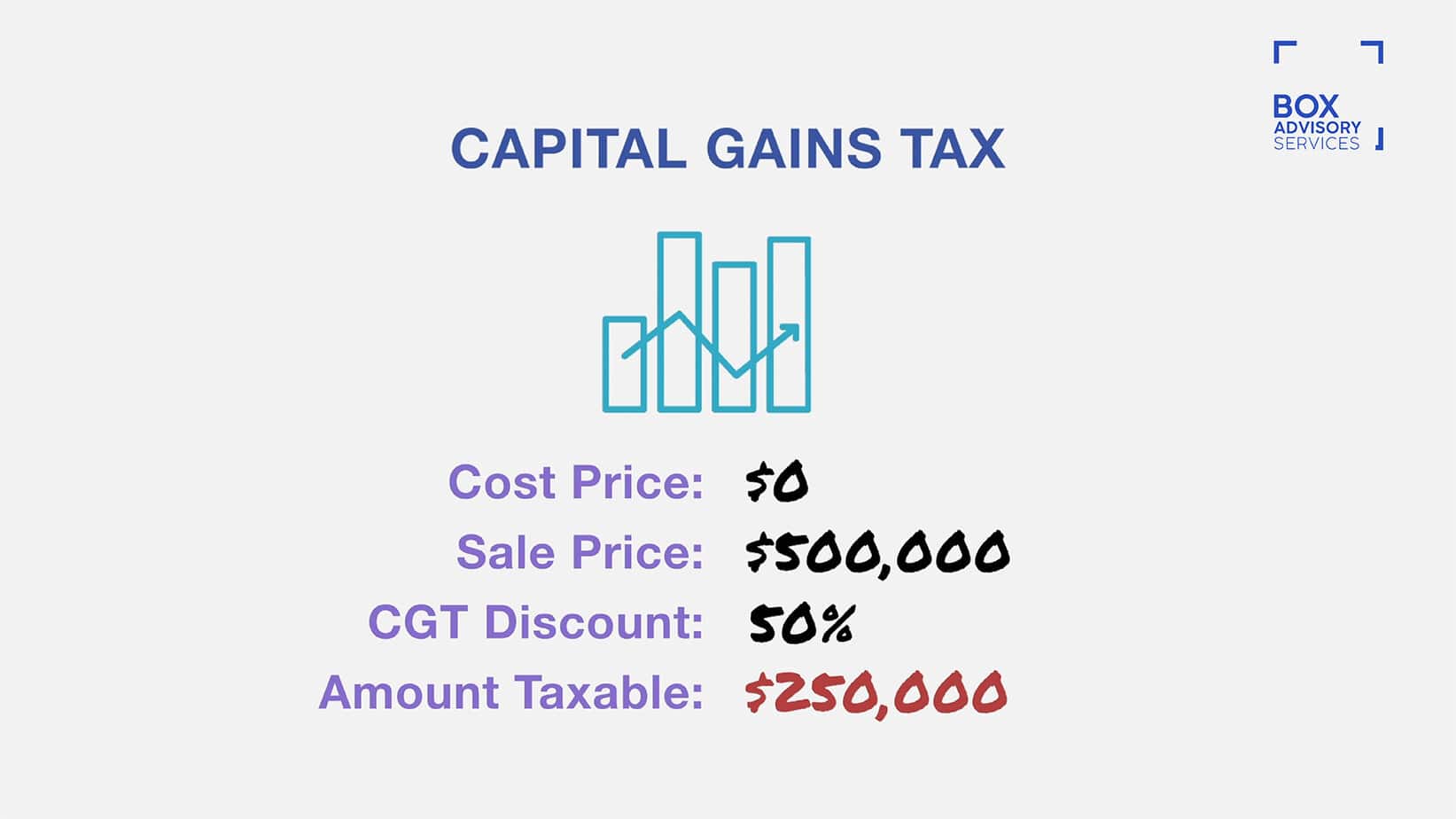

Share sales are considered pro-seller in many instances primarily for reasons related to relinquishing the majority of seller liability in the business as this is transferred to the new owner. In addition, a share sale transaction tends to result in a better overall return for the seller and a 50% capital gains tax (CGT) concession on the sale of the business if they have owned the business for more than 12 months (the shares must be owned individually or in a trust). The sale of shares of a business can also allow the shareholder to easily access small business CGT tax concessions which can result to the shareholder paying nil tax on profits of the sale of the company shares.

Seller Disadvantages of a Share Sale

As a seller, in order for a successful business transaction to occur, they may be required to provide extensive information, warranties and indemnities for historical liabilities of the business. In such instances, a personal guarantee is often required which may expose them to unlimited personal liability.

Key Takeaways

Whilst there are some clear-cut advantages for buyers and sellers whether it be an asset sale or a share sale, what’s important is to consider what type of business you are buying and selling in the context of what you plan to do with the business or its assets.

What’s common across all of these options is to ensure that the appropriate due diligence is being conducted to ensure an informed decision is being made. Engaging in a qualified lawyer or accountant will help you to navigate this complicated process as it can expose buyers and sellers to unnecessary risk if not conducted properly. Box Advisory Services can assist in assessing your options to provide you with the right guidance in making a decision that’s most suitable for you. To do so, simply book a free 45-minute consultation with us to find out more.

Sign up to our monthly newsletter where we share exclusive small business and contractor advice!

Disclaimer:

Please note that every effort has been made to ensure that the information provided in this guide is accurate. You should note, however, that the information is intended as a guide only, providing an overview of general information available to contractors and small businesses. This guide is not intended to be an exhaustive source of information and should not be seen to constitute legal or tax advice. You should, where necessary, seek your own advice for any legal or tax issues raised in your business affairs.