BY

|

Personal Services Income: 4 Steps To Tell If You’re Subject to PSI Rules

Following the Review of Business Taxation report in 1999, various recommendations were made due to growing concerns that individuals were sidestepping the tax implications of personal services income through the use of interjectory companies. contract

As a result, many individuals were getting away with paying less income tax and having access to greater tax deductions in comparison to those available to employees.

So, in 2000, various rules were introduced to better govern individuals who earn personal services income.

Despite being introduced 20 years ago, many small businesses and contractors are either unaware of the rules or don’t fully understand them.

In this article, we will cover the full extent of these personal services income rules to help you determine whether or not they apply to you.

What Is Personal Services Income?

According to the Australian Tax Office (ATO), personal services income (PSI) is income produced principally from an individual’s personal skills, expertise and labour.

In particular, it’s income that isn’t derived for the sale of goods, but rather through the sale of personal services.

Who Does Personal Services Income Apply To?

While many professionals fall into the personal services income category, the ATO identifies a few common examples, namely:

- financial professionals;

- engineers;

- medical practitioners;

- IT consultants; and

- construction workers

Example 1:

Jacob is an IT consultant who provides his expert services to various companies. He specifically helps assess his client’s technology challenges.

In assessing and solving these technology challenges, Jacob primarily uses his client’s equipment and software.

Consequently, his income is derived from his personal skills, expertise and labour.

Shaun, on the other hand, runs a business where he sells computer hardware, software and spare parts.

Although he is responsible for the installation of the spare parts or hardware, the installation costs are generally included in the price of the hardware or spare parts.

As a result, the income he derives from his business is primarily based on the sale of goods, rather than the sale of personal services.

How Do You Determine If Personal Services Income Rules Applies To You?

To determine whether or not the personal services income rules apply to you, the ATO prescribes working through various steps.

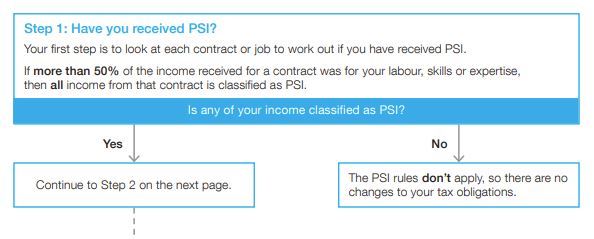

- Step 1 requires you to determine whether you have received any PSI by assessing each contract or job that you have undertaken.

If, after your assessment, you have established that more than 50% of your income received was for your personal skills, expertise or labour; then that income is classified as PSI.

The next few steps involve determining whether or not you are running a personal services business (PSB). If your business is considered a PSB, the PSI rules will not apply to that income.

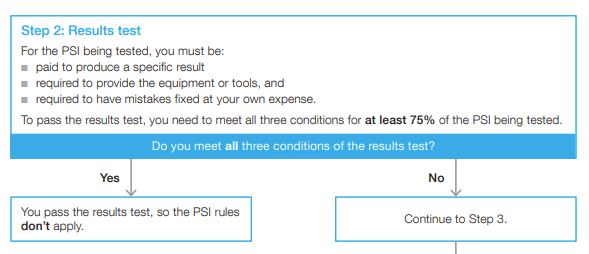

- Step 2 requires you to undergo the “results test”. An individual or entity will be considered a PSB if they meet the following conditions for at least 75% of the PSI being tested:

- you must be paid to achieve a specified result;

- you must provide the equipment or tools necessary (if any) to achieve the specified result; and

- you must be required to remedy any defective work at your own expense.

Example 2:

At least 75% of Jessica’s clients pay her to produce tailor-made project management software. She creates the software using her own equipment; and if her clients require her to remedy any defects in the software, she does so at her own expense. In other words, she does not bill the clients for the time spent solving the problem.

Jessica’s project management software entity is considered a PSB because she meets the conditions set in the results test.

Suppose you don’t meet the conditions set in the results test. In that case, there are three other tests available. However, to consider the other tests, you have first to take account of step 3.

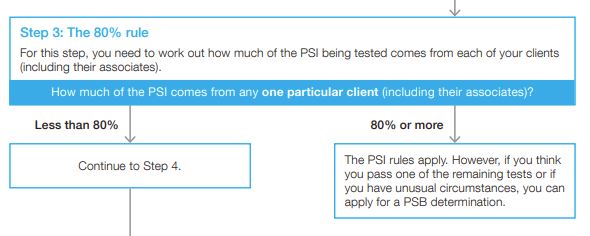

- Step 3 requires you to determine how much of your personal services income comes from one particular client (and their associates). If 80% or more of your PSI comes from just one client, then the PSI rules apply.

If your PSI from each source is less than 80%, you can proceed to the remaining self-assessment tests.

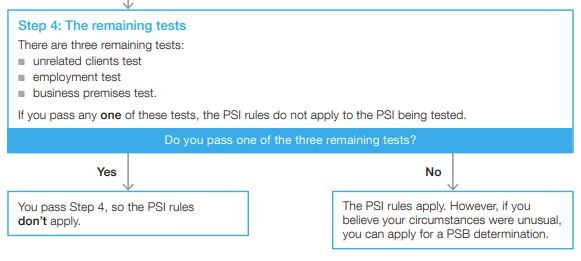

- Step 4 requires you to undergo three different tests:

- The unrelated client test involves determining whether or not you provide your services to 2 or more unrelated entities and whether or not you provide your services as a direct result of advertising to the general public.

- The employment test entails determining whether you have employees, contractors or partners performing at least 20% of the principal work.

- The business premises test requires your work premises to be owned or leased exclusively by you; to be used for personal service work more than 50% of the time, and to be physically separate from your residence and clients premises.

Should you pass either one of the three tests, the PSI rules won’t apply to you. If, however, you don’t pass either test, then the PSI rules will apply to you.

Example 3:

Luke is an engineer who operates through a company called LJM Engineering (Pty) Ltd. Currently, Luke’s entity offers its services to three different clients.

More than 50% of the company’s income received was for Luke’s personal skills and expertise. As a result, the income is considered PSI.

After undergoing the results test, Luke realises his company is not considered a PSB, because he bills his clients per consultancy hour.

After proceeding to step 3, Luke establishes that 83% of his PSI comes from Client A, one of the clients he consults for.

Consequently, the PSI received by Luke’s personal services entity is attributed back to him. This means that the income tax liability is transferred from LJM Engineering (Pty) Ltd to Luke, and he must declare the income on his individual tax return.

The Personal Services Income Online Tool

The rules and steps can be quite complex, so if you’re still struggling to figure out whether the personal services income rules apply to you or not, the ATO also provides a helpful online tool.

Following a series of questions, the tool will provide you with a report that details whether your income is PSI and if the rules apply to you.

What Happens When PSI Rules Are Applicable To You?

If you have determined that the personal services income rules apply to you, there will be limits to the deduction that you can claim against your income.

Generally, if you earn personal services income, you will be regarded as being in the same position as an employee for tax purposes.

If, after completing all the steps, it’s clear that the PSI rules apply to you, then the amount of PSI will need to be attributed back to you. In other words, you will need to include this income on your annual tax return.

To determine what deductions you can claim when receiving PSI, you can visit the ATO’s website.

What Is Attributed Personal Services Income?

Attributed personal services income involves having your PSI paid to you as an employee, through your personal services entity (i.e. the company you manage your personal services through).

If your PSI is paid to a personal services entity, the income (minus the expenses incurred while producing that income) is attributed to you unless:

- the personal services entity gained the income in the course of conducting a PSB; or

- the income was immediately paid to you by the entity as salary.

Key Takeaways

Through the use of interjectory companies, it had become frequently more common to pay “small business” tax and avoid paying higher personal income tax.

So, although there was this “employee-like” situation for individuals who sold their personal services, they were able to pay less income tax and benefit from a greater range of deductions than individuals in legitimate employee positions.

As a result, personal services income rules were introduced to improve the integrity and equity of the Australian tax system. The introduction of these rules aimed to prevent the evasion of the tax implications that come with earning a PSI.

The rules can get quite complicated, so the ATO provided a step for step process, along with other online resources, to help you determine whether the rules apply to you or not.

If you’re a contractor or small business owner and suspect that you may fall under the PSI rules, it may be helpful to contact our expert team of small business accountants.

At Box Advisory Services, we provide personalised and affordable taxes to cover all your accounting, tax and CFO needs.

To find out how we can help you, book in a free consultation today.

Sign up to our monthly newsletter where we share exclusive small business and contractor advice!

Disclaimer:

Please note that every effort has been made to ensure that the information provided in this guide is accurate. You should note, however, that the information is intended as a guide only, providing an overview of general information available to contractors and small businesses. This guide is not intended to be an exhaustive source of information and should not be seen to constitute legal or tax advice. You should, where necessary, seek a second professional opinion for any legal or tax issues raised in your business affairs.